Creation of TCE: “Proving” the value of a new form of IT outsourcing

In the late '90s, as enterprises scrambled to capitalize on the cost advantages of offshore outsourcing, Softtek took a different approach. Recognizing the growing limitations of traditional offshore models, Softtek pioneered the nearshore outsourcing concept in 1997, built on the unique advantages of geographic proximity and cultural alignment. The goal was to create a model that offered cost efficiencies while minimizing hidden expenses like productivity losses, communication barriers, and high attrition rates.

Around this time, several Latin American countries, including Mexico and Brazil, began investing heavily in technology hubs, leading to an influx of companies positioning themselves as competitive alternatives to Asia’s established outsourcing destinations. With Softtek leading the charge, nearshoring rapidly gained traction as a strategic option for companies seeking closer collaboration and higher engagement efficiency.

Nearshore took off because it just made sense—practical from a cost, cultural, and proximity standpoint. As one speaker put it during Softtek’s Digital Innovation 2024 conference with the US-Mexico foundation, “None of you guys and your companies would’ve bought services nearshore. Everything can sound great, but if the economics are not there, this concept just wouldn’t happen.”

But despite the benefits of nearshore, many newcomers were hesitant due to sticker shock. On paper, nearshoring appeared more expensive than offshoring, which had long been considered the go-to solution for cost reduction.

Softtek knew it would take more than just proximity and cultural alignment to convince the market of nearshore's value, so in 2005, we introduced Total Cost of Engagement (TCE)—a framework that provided a more comprehensive view of outsourcing costs.

The purpose of TCE

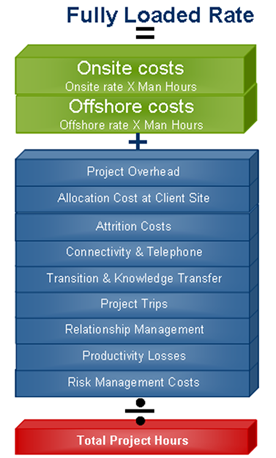

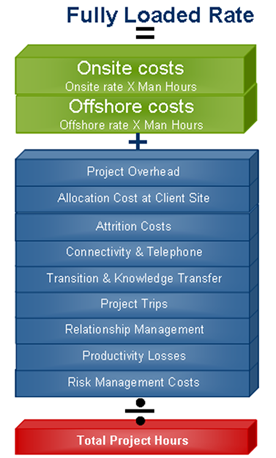

The TCE was designed to give businesses a clearer understanding of the true costs associated with outsourcing engagements. At the time, companies were primarily focused on man-hour rates, seeing offshore outsourcing as the ultimate solution for reducing expenses. But this narrow focus failed to account for the numerous hidden costs that could diminish those savings over the course of the relationship.

The purpose of TCE was to move beyond simply measuring the direct costs of labor and instead capture a holistic view of an engagement's overall expenses. TCE takes into consideration factors such as attrition, project overhead, geopolitical risk, travel, and communication expenses.

By highlighting these indirect costs, TCE showed that what may look cheaper on paper (offshoring) could often end up being more expensive when considering the full scope. This approach allowed businesses to see that nearshore outsourcing can offer greater efficiency, collaboration, and value over time.

Key tenets of TCE in 2005

To understand the true costs of an outsourcing engagement, Softtek’s TCE model included a range of factors beyond man-hour rates. Here’s how the key components stack up:

- Offsite leverage: Offshore vendors often achieve 60-65% Offsite Leverage, meaning a large portion of work remains at the client site, driving up costs. With Softtek’s Near Shore® model, Offsite Leverage regularly exceeds 80%, meaning more work is done at lower-cost, nearby locations, improving overall cost efficiency.

- Formula: TCE Net Hourly Rate = (On-site Man/Hours * On-site Rate) + (Offshore Man/Hours * Offshore Rate)

- Project team costs: Offshore man-hour rates are lower, but total project team costs must account for both on-site and offshore work. Nearshore reduces on-site needs, lowering overall costs.

- Formula: Project Team Costs = (On-site Man/Hours * On-site Rate) + (Offshore Man/Hours * Offshore Rate)

- Vendor attrition costs: High attrition in offshore engagements leads to added expenses for knowledge transfer and reduced productivity. Nearshore’s lower attrition rates result in fewer disruptions.

- Formula: Attrition Costs = Attrition Rate (%) * Number of Resources * Time to Replace * Rate

- Project overhead: Offshore models often require redundant management teams to overcome time zone and distance issues, adding unnecessary costs. Nearshore’s proximity reduces the need for extra oversight.

- Formula: Project Overhead = (On-site Man/Hours * On-site Rate) + (Offshore Man/Hours * Offshore Rate)

- Allocation costs at the client site: On-site work incurs additional expenses for office space, utilities, and supplies, which are minimized with higher Offsite Leverage in nearshore engagements.

- Formula: Allocation Costs = On-site Resources * Monthly Facility Cost * Number of Months

- Telecommunication and travel costs: Offshore engagements drive up costs with long-distance communication and travel. Nearshore reduces these through geographic proximity, shorter flights, and real-time collaboration.

- Formulas:

- Data Communication Costs = Monthly Data Link Costs * Duration (Months)

- Travel Costs = Airfare + Hotel Costs + (Man/Hours spent traveling * Hourly Rate) + Per Diem

- Transition and knowledge transfer (KT): Fees associated with onboarding and knowledge sharing are minimized in nearshore engagements due to ease of travel and closer collaboration.

- Formula: KT Costs = (Vendor’s Resources On-site * On-site Rate) + (Client Man/Hours for KT * Client Man/Hour Cost)

- Geopolitical and risk factors: Offshore engagements often come with risks related to security, intellectual property, and legal frameworks. Nearshore locations like Mexico and Colombia (having gained popularity in recent years) offer greater stability and stronger cross-border legal protections.

Calculating TCE is a lot more complicated today (and that’s a good thing!)

While the original TCE model provided a comprehensive view of outsourcing costs in 2005, the landscape has evolved significantly in the last two decades. For example, telecommunication costs, once a key driver of engagement costs, have become practically obsolete with the rise of enterprise communication tools. Meanwhile, emerging technologies and modern engagement models have added new layers to the financial impact of a partnership. Today, there is a greater focus on the business value delivered by the engagement.

Here are some additional considerations for a modern Total Cost of Engagement calculation:

1. Value-driven partnerships

- 2005: When TCE was introduced, many engagements were still structured around staff augmentation—bringing in external talent to fill gaps in internal teams. The focus was primarily on cost savings through lower hourly rates.

- Today: There has been a significant shift toward outcome-based engagements and managed services, where providers are held accountable for delivering results and increasing efficiencies. This evolution prioritizes value creation, rather than reducing labor costs alone. Many modern engagements are structured with year-over-year performance targets, such as improving productivity through automation or driving innovation via AI-driven insights.

Implication: Today’s TCE model must consider both engagement costs and the value of deeper, strategic partnerships. These partnerships focus on mutual growth and long-term efficiency, going far beyond staff augmentation.

2. Mature nearshore providers and technology arbitrage

- 2005: Nearshore outsourcing was still emerging as a viable alternative to offshore, with a focus on labor arbitrage and geographic proximity.

- Today: Mature nearshore companies now offer more than labor cost savings, delivering technology arbitrage through automation, AI integration cloud, low-code/no-code, and self-service. These innovations reduce manual effort, accelerate time-to-market, and ensure scalability. Providers are increasingly focused on embedding these technologies into clients' day-to-day operations, driving continuous improvement and long-term efficiency. This positions nearshore providers as strategic partners, helping businesses achieve monetary impact through technology.

Implication: The modern TCE model should capture the added value of technology arbitrage powered by AI, automation, and cloud. This focus on technology-driven efficiency sets nearshore providers apart from traditional outsourcing models, positioning them as key partners in driving both cost savings and tech advantages.

3. Agile and innovation potential

- 2005: Many outsourcing engagements followed traditional waterfall models, with innovation occurring sporadically or as part of discrete projects.

- Today: Agile frameworks have become a standard for delivering software and services, enabling faster iterations, greater adaptability, and a culture of continuous innovation. Nearshore providers excel in Agile environments, offering teams that can operate at speed, collaborate in real-time, and innovate on-the-fly. Innovation potential is now a critical factor in determining the long-term success of any outsourcing engagement, and businesses increasingly rely on providers to help push the envelope with creative solutions, faster deployment, and scalable innovations.

Implication: TCE today must incorporate the potential for continuous innovation and Agile collaboration, both of which drive not only cost efficiencies but also competitive advantages in rapidly evolving markets.

4. Mature governance models

- 2005: Governance models in outsourcing engagements were primarily focused on managing scope, costs, and timelines, often requiring heavy oversight.

- Today: Governance has matured significantly, with advanced project management frameworks and dashboards with real-time performance metrics. Modern governance models emphasize collaborative accountability between client and provider, ensuring transparency and agility without excessive layers of management. Mature nearshore providers now offer integrated governance, streamlining decision-making and aligning on strategic objectives.

Implication: The cost of governance is no longer about adding layers of oversight but about creating efficiency through streamlined, transparent management systems. These models improve the speed of decision-making, reduce risks, and drive alignment across both sides of the engagement.

5. Evaluating both costs and value in today’s TCE

- 2005: TCE was mostly about cost accounting—capturing all direct and indirect expenses tied to an outsourcing engagement.

- Today: TCE goes beyond costs to also measure value. While cost accounting looks at what a company spends, value creation measures what a company gains. Modern engagements prioritize outcome-based models, which focus on operational efficiencies, revenue growth, and competitive advantages. Key dimensions of value creation include:

- Operational efficiencies: By automating repetitive tasks and improving workflows, companies can reduce their long-term costs while increasing productivity.

- Faster time-to-market: Agile, nearshore teams can help businesses deliver products faster, increasing their competitiveness in fast-moving markets.

- Revenue growth: Innovation driven by outsourcing can lead to new product development, improved customer experiences, and new revenue streams.

- Scalability: Nearshore partners help businesses scale up operations quickly without proportionally increasing overhead, allowing for more profitable growth.

- Competitive advantage: In industries where speed and innovation are key, outsourcing can help a business stay ahead of its competitors by enabling faster innovation cycles and more agile responses to market changes.

Implication: By evaluating both costs and value delivered, today's TCE provides a more complete view of the overall impact of an outsourcing engagement, turning outsourcing into a strategic lever for growth and innovation.

Conclusion

For companies rethinking their outsourcing strategy, this article underscores the continued relevance of the TCE model, first introduced in Softtek’s 2005 whitepaper. By embracing modern factors like value-driven partnerships, automation, and innovation potential, mature nearshore partners offer strategic advantages that not only control costs but also drive business forward.