The Roundtable Roundup: Moving at the speed of consumer shifts

During our last Digital Innovation X Leadership Forum 2021 virtual roundtable, two leaders from very different industries converged to discuss the topic of moving at the speed of consumer preferences and how their respective industries are quickly responding. We discovered that the retail and media and entertainment (M&E) industries have more in common than you may think. Both industries are solving for the same things:

- Building an on-demand and frictionless customer experience as well as digital solutions that differentiate

- Driving brand loyalty and platform utilization

Read on for a summary of the topics discussed and the key insights discovered.

Building an on-demand and frictionless customer experience

When it comes to building an on-demand frictionless customer experience today, your technology stack must be bleeding-edge. This means your user experience needs to be personalized, frictionless, convenient, and let's face it, it has to be cool too! But your brand also needs to be able to compete in many other areas. Applying Barbara E. Kahn's Retailing success matrix to the equation, modern retailers and M&E companies need to be ready to differentiate across four main categories: Product Brand, Price, Experience, and Frictionless. And while some brands, large and small, found the sweet spot, many are still playing catch-up.

Who's winning in retail?

For many, Amazon probably comes to mind. But how do traditional brick-and-mortar retailers fare? Specifically, brands like Sephora are pulling ahead. Why? Sephora disrupted the retail cosmetic industry early, doing away with the "perfume-paparazzi" and glass counters behind which an associate attempts aggressive sales tactics as you sample the product. Compared to department stores, there's zero pressure shopping at Sephora, where non-commissioned beauty consultants let you try before you buy (or don't buy), offer workshops, and are glad to personalize the experience based on the shopper's needs. But that alone did not help them win; Sephora was also early to create a customer-centric omnichannel experience, with digital channels that meet customers where they want to shop and provide critical data for retail personalization. And guess what? Loyalty followed, and so did profits.

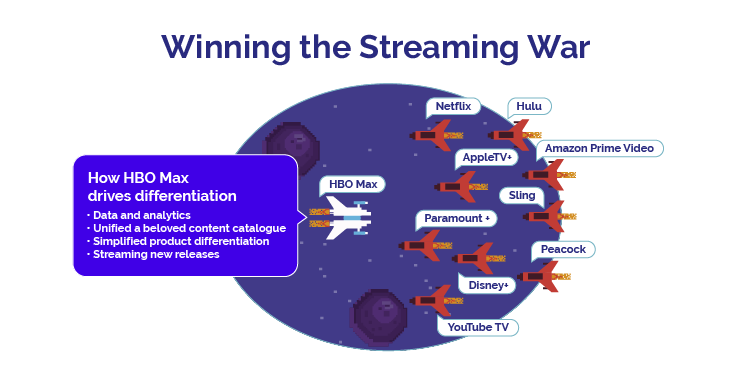

Lights, Camera, Streaming Wars

Conversely, M&E companies that once competed for box office sales have been thrown into the over-the-top (OTT) media wars and forced to compete with native digital companies who had a healthy head start and massive data intelligence like Netflix and Amazon. Nobody knows this better than Rohith Nandagiri, Director of HBO Max Analytics- Operations and Data Governance, who noted during the roundtable, "We're not a native technology company, so it was certainly a challenge to ingest the volume of data we were receiving."

However, HBO Max eventually hit its stride, now recognized as a top streaming service, and data is the fundamental tool for how Rohith and his team got there. They used data and analytics to drive customer acquisition and platform utilization. The OTT market is increasingly crowded, and all major studios have launched subscription streaming services. It's never been easier to cut the cord and de-bundle from your cable provider, making it difficult for M&E companies to drive and retain subscriptions and not get lost on overcrowded devices.

Driving brand loyalty and customer lifetime value

First-party data can be valuable, providing a goldmine of qualitative and quantitative data to drive business decision-making. And although many brands leverage data to inform their business decisions, some struggle with the disconnect between data collection and driving meaningful insight through analytics. Rohith reminds us that for companies who are not digitally native, landing that kind of data and converting it into actionable business objectives is not an easy task and is a significant disadvantage when you need to move quickly to address customers' evolving needs. Rohith further noted your options are to get more Agile or become the disruptor, putting companies in a great position to earn dollars and loyalty through better data and analytics.

-2.png?width=751&name=MicrosoftTeams-image%20(1)-2.png)

Retail is getting kind of HARRY

Digitally native direct-to-consumer (D2C) brands like Harrys and Dollar Shave Club saw a unique opportunity to deliver an end-to-end unified customer experience and disrupt the traditional transactional retail model, quickly getting the attention of brick-and-mortar retailers and incumbent brands like Gillette. Through this approach, eCommerce brands disrupted men's personal care, allowing these companies to own their data, brand, and shopping experience. This has helped these modern retailers survive and thrive during the pandemic with full autonomy over their CX, marketing, and distribution.

Big box retailers and brands have responded by offering rival omnichannel experiences, including click-to-curb services, and have leveraged their massive data and intelligence to drive customer loyalty and personalize the shopping experience. This has helped retailers and brands slow D2C momentum and continue to further guarantee their long-term success and differentiate in ways D2C brands just can't.

Measure what matters

Data, specifically first-party data, helps HBO Max personalize the user experience by offering content recommendations and gives their team the ability to build a more intuitive and personalized viewing experience for 14 different viewing personas. Getting the right data is critical to improving utilization across its platform to pinpoint where, when, and why to make investments. As Rohith explains, more data in many ways means more decisions, but having the intelligence provides an opportunity for leaders to identify the right KPIs to make smarter tradeoffs.

The big takeaways

Moving at the speed of consumer shifts has become synonymous with moving at the speed of Amazon, and retailers and M&E companies need to dial up their capabilities and orchestrate like a data-driven platform to match the high standard Amazon has trained consumers to demand. Does your brand check all the boxes?

- Are you capturing the most important data and signals across your ecosystem, and is your organization agile enough to move at the speed of real-time intelligence?

- Are you operating like a digitally native company? If not, how do you close those gaps before they get too wide?

- Is your brand differentiation clear? Do customers see your value? Are you ready to compete in the era of disruption?