The future of the financial sector in a post-Covid world

There is no doubt that, in the first instance, the coronavirus crisis has led to increased uncertainty, risk and volatility in the market. In the financial sector, data points to how European banking has contracted to 2009 levels. The net profit of banks in Europe will see a reduction in the next few years of 30 billion euros.

Although the year had begun positively, reviving credit and even increasing its price by 20%, the coronavirus has truncated this improvement and cases of insolvency and loan defaults are beginning to shoot up. Non-performing loans are starting to rise and will continue to do so even more.

Medium-term effects of the crisis on the market and its customers

One of the most plausible effects that the coronavirus crisis is going to leave in terms of transformation of the sector is, without a doubt, that of digitalization. And this transformation is going to take place from a double perspective: that of internal work processes and that of interactions with customers.

Firstly, isolation measures have greatly boosted the importance of changes in customer service centres and their remote support capabilities. The large Contact Centers of the banks have been facing severe structural changes focused on their digitalization, and the implementation of teleworking measures.

Automated channels (chatbots, virtual assistants, etc.) have been strongly enhanced while human workers have improved their digital assistance skills. On the other hand, at times when people have been experiencing problematic or stressful situations, customer service staff have greatly enhanced their empathic skills.

The impact on work flows and processes has been great and permanent. The coronavirus epidemic has left in its wake a huge exodus from traditional offices, branches and corporate centers, to a new reality of working remotely and from home.

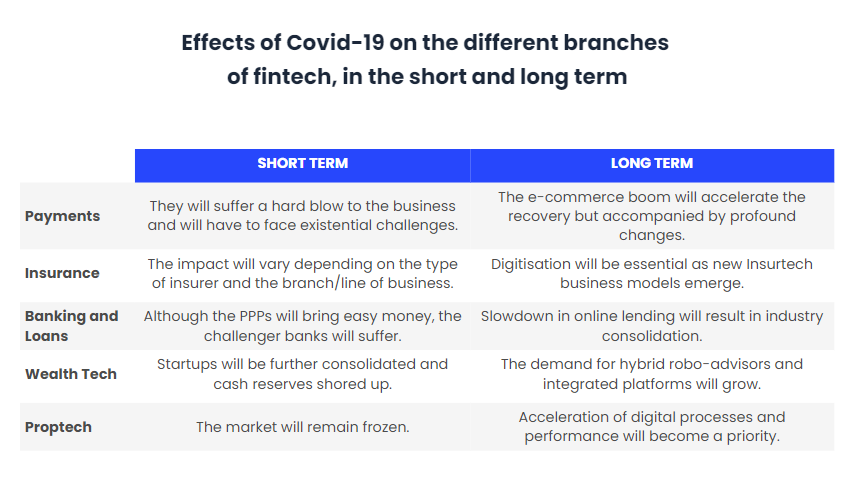

In the short term, consumers will turn to containment in the level of risk of their investments. This trend towards a more conservative approach will impact essential product lines such as mutual funds or term products.

But on the other hand, the demand for new digital banking services will grow strongly, forcing many traditional institutions to double their efforts in innovation and development of new fintech tools.

In this respect, the trend towards collaboration between banks and fintech could be key in the wake of the crisis, and experience another new impulse, especially when financing options obtained through venture capital are no longer so feasible for startups.

Take-off of technological innovation in banking

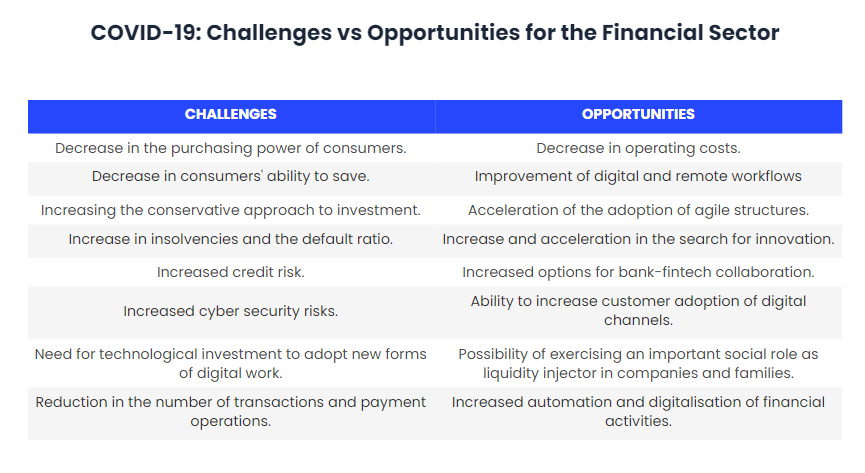

The coronavirus crisis has brought many challenges, but also opportunities, especially in the area of digital transformation, which has accelerated with the aim of finding solutions to this situation. The challenge now is to continue to move forward and to continue to make progress.

The rise of the robo-advisors

The impact of the Covid-19 crisis has also affected the robbery-advisor sector, which could experience a series of changes as a result of the increased digitalization of financial services in recent months due to distance and control measures.

But despite this, many investors still want a certain relationship with human advisors, which is why in the first quarter of 2020 the robo-advisors using a hybrid advice were the ones who obtained the best figures. In the long term, and as a result of the changes brought about by Covid-19, the use of these hybrid advisory platforms could increase exponentially.

On the other hand, small robo-advisory firms will be the ones most affected by the impact of this crisis, which will make it more difficult for them to be profitable and they will have to integrate into other startups that are more recognized and more established.

The Covid-19 may increase, in the future, the need for automatic financial solutions, and mainly due to the fact that consumers, in these last months, are saving more money, the startups of the Wealthtech segment are developing platforms more oriented to a millennial user, and are getting more financing. This shows that investors are quite confident in this area.

Towards a cashless society

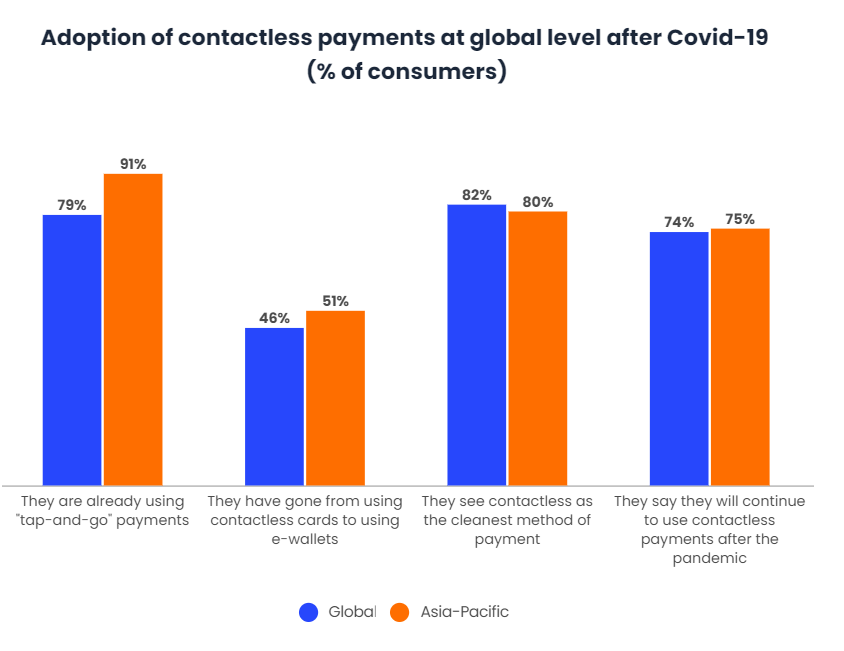

The adoption of digital payments has been growing over the last decade. The appearance of e-commerce, mobile payments, e-wallets or crypto-currencies have been some of the catalysts of this growth.

However, in all this time, digital payments have not yet been able to displace cash as the main means of payment for consumers.

The magnitude of the change in behaviour brought about by Covid-19 could be the definitive trigger for the change in trend. Minimizing the risks and preventing the transmission of the virus is the argument on which many users around the world have based their change in behavior, and adopt digital payments over cash.

The change in habits also has to do with a change in perception about the advantages of contactless payment. Thus, according to the data, 82% of users globally already perceive contactless as the most hygienic form of payment and 74% ensure that they will continue to use this method once the pandemic is over. According to this, the use of cash and ATM transactions would have decreased by 60% worldwide since the beginning of the confinement.

The take-off of automated credits

The Covid-19 pandemic is increasing the importance of Artificial Intelligence for many business areas. One of the most prominent is online lending, the demand for which may increase dramatically in the near future, mainly because many businesses and individuals, who only a few months ago were in a good financial situation, are now having to resort to loans in order to stay afloat.

The online lending business is currently facing a crucial moment. On the one hand, the added risk of lending to individuals and businesses in times of crisis could be a burden, but on the other hand, the use of online data to assess credit and the possibility of lowering interest rates, as it requires less infrastructure, could eventually lead to a new boost for this emerging industry.

In this regard, alternative credit-scoring systems, based on Artificial Intelligence, can also play a very important role in ensuring much more accurate and appropriate assessments of potential risk. Artificial Intelligence and Machine Learning are beginning to be postulated as the essential technologies for improving these processes.

Online credits will be crucial for many companies and individuals to continue their activity during the post-Covid-19 crisis period.

In order to prevent debt and the risk of non-payment from skyrocketing, it will be necessary to speed up and make the processes for granting loans more efficient, while maintaining compliance with regulations.

The need for video banking

For banks, one of the first consequences of the Covid-19 pandemic was to be forced to reduce branch opening hours and take extreme security measures in the branches, encouraging consumers to use online and mobile channels instead of going to the physical establishments.

Video banking services have been proliferating slowly over the last few years, without reaching a level of mass popularity. However, there is now a new opportunity for them, in what some are beginning to call “the era of social distance”.

The moment of financial instability that we are experiencing, combined with the need to reduce human contact, which the authorities are promoting, places video banking technologies in a very suitable position to establish themselves as the solution for maintaining security and social distance without losing that element of human contact that consumers still demand.

For example, the use of ATMs with video call service grew already last year 2019, but these ATMs are experiencing an even greater boom as a result of the Covid-19 crisis. However, the space where video banking is finding the most potential is in mobile apps and websites of financial institutions, where 89% of users who have used one of these options have said that the service was very useful.

Video banking has gone from being a “novelty” (or a dazzling innovation for consumers eager for a superior customer experience) to becoming a highly demanded need. And it may eventually establish itself as the ultimate “phygital” channel, combining the best of digital self-service with the face-to-face experience.

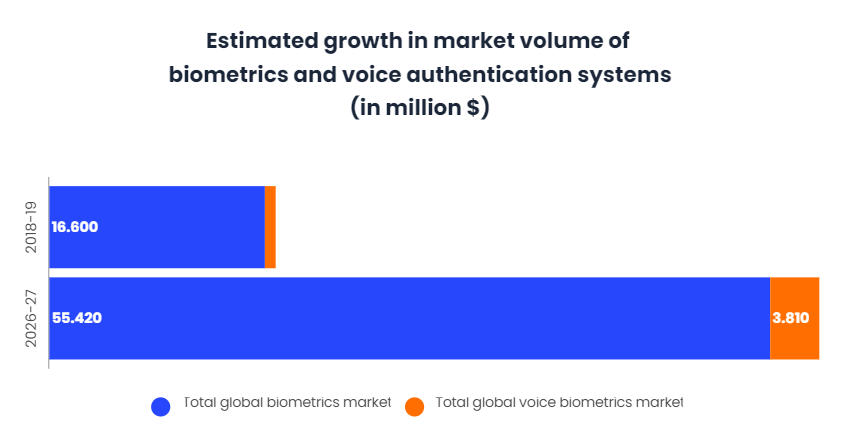

Voice biometrics in the middle

The Covid-19 crisis has put biometrics back at the centre of the debate on innovation in authentication systems. Whether through voice or facial recognition systems, the demand for this technology is growing exponentially, especially from sectors such as finance, utilities or telecommunications. According to the data, the market for biometric technologies points to strong growth in the coming years, rising from 16,600 million dollars generated in 2019 to 55,420 million dollars in 2027.

These systems are proving their worth in facilitating remote work, and providing more secure access to accounts or financial information.

On the other hand, in a scenario where cash may no longer be in circulation, a method such as voice authentication is beginning to emerge as the main technology for securing operations without the need for physical contact.

Voice biometrics can also play an essential role as a prevention and detection system for Covid-19, to ensure the health levels required for the operation of offices and public spaces.

The impact of cryptomontages

The transformations resulting from the Covid-19 crisis are prompting reflection on the impact that these may have, in the long term, on many areas of financial services. Immediate concerns, such as digital privacy, cyber security, the need to inject credit into companies, possible deflations or inflation, are arguments that experts are using to make their projections for the future.

One of the areas on which the debate is revolving is Blockchain and, more specifically, crypto-currencies. One of the most important factors that experts are taking into account is the new global economic reality that is going to emerge in the post-Covid stage, in which as governments see the need to introduce stimuli to protect the pillars of their economies, the flow of liquidity stored in cryptosystems is going to increase.

The crypto-currency industry would therefore be facing a historic moment in which a great change of discourse is taking place regarding its importance and the innovative role it can play in the financial sector.

Conclusions

The Covid-19 crisis is going to cause large-scale impacts on the financial business. The positive or negative magnitude of this impact will be determined by the actions taken by the entities.

One of the great opportunities is the possibility that financial entities will adopt a role of social support to families and companies, acting as a support for the government when injecting liquidity into the economy.

On the other hand, there is a great opportunity to strongly reduce costs by definitively eliminating part of the traditional physical structures that were very costly.

Banks can take advantage of the crisis to test new ways of working remotely, more efficient for both employees and consumers, and boost innovation and the development of digital tools and new fintech products and services.