Health Insurers' Guide to Incentivizing Fitness Tracker Data Sharing

Health insurance organizations rely on various data sources, such as medical and pharmacy claims, electronic health records, and public health data to inform their business operations. However, there’s a new category of data emerging that could transform the industry – wearable technology and monitoring devices. In fact, the wearable fitness trackers market size is projected to reach US $192 billion by 2030, at a CAGR of 17.5%. The question of sharing fitness tracker data is certainly a controversial topic, but it could be a win-win for both insurers and customers by improving population health and business outcomes.

As the industry becomes more digital, Insurtech and insurers will likely start incorporating this valuable data into their business models, primarily to increase loyalty and enhance their offerings. In this article, we will explore three near-future health insurance buyer journeys and how insurers can address the unique belief systems and needs of different customer segments when collecting wearables data. We’ll also discuss the importance of empathy and transparency when incentivizing customers to share this data. Finally, we will explore considerations for building a robust data practice that leverages both wearables technology and other available data sources.

3 near-future health insurance buyer journeys

Timmy (father of young family)

Timmy is a 40-year-old man who recently started a new job and is considering two health insurance options offered by his employer. He has a good job and financial stability and is looking for a family plan that covers himself, his wife, and their two children.

Timmy is a 40-year-old man who recently started a new job and is considering two health insurance options offered by his employer. He has a good job and financial stability and is looking for a family plan that covers himself, his wife, and their two children.

One of the two insurers is a brand Timmy isn’t familiar with, but it offers a lower rate if his family agrees to share fitness tracker data. They can even get additional discounts if they stay within certain healthy thresholds over time. However, the company is entirely digital, replacing agents with self-service digital channels for most customer processes.

While Timmy and his family like the idea of a discounted plan, they are wary of their personal data being sold, stolen, or mismanaged by an unfamiliar insurer. In addition, despite the convenience of digital channels, they find them impersonal and prefer working with a familiar brand and a trusted agent. As a financially stable family, Timmy and his wife are willing to pay more for a plan that they feel offers reliable coverage and good customer service.

Food for thought:

According to a recent survey, 65% of all consumers plan to use an insurance agent in the future. How can insurers move more customer processes to digital channels while still providing the same levels of trust and customer service that agents do?

Beyond savings, what benefits could an insurer offer to win over customer segments like Timmy’s?

Tammy (healthy young adult)

Tammy is about to turn 26 years old and must find her own health insurance since she will no longer be eligible for coverage under her parents’ plan. She doesn’t have much money and leads a healthy lifestyle, wearing a fitness tracker to monitor her progress.

Tammy is about to turn 26 years old and must find her own health insurance since she will no longer be eligible for coverage under her parents’ plan. She doesn’t have much money and leads a healthy lifestyle, wearing a fitness tracker to monitor her progress.

She is not only looking for an affordable insurer, but also one that encourages good health. For Tammy, the incentives and rewards offered by her insurer must be more than just monetary; she wants an insurer that will actively support her health journey and provide her with the tools and resources she needs to stay healthy.

Food for thought:

How can health insurance companies play a more active role in their clients’ wellness journeys?

How can insurers build awareness of wellness programs and benefits, make them more accessible, and encourage healthy behaviors?

How can insurers differentiate themselves from other companies offering similar benefits?

Tommy (retiree with some health complications)

Tommy is a 65-year-old man who has recently retired and is now eligible for Medicare. He is considering his options for Supplement Medicare plans, including parts B, C, and D. As someone on a fixed income who also suffers from health complications, his top priority is to reduce his healthcare costs.

Tommy is a 65-year-old man who has recently retired and is now eligible for Medicare. He is considering his options for Supplement Medicare plans, including parts B, C, and D. As someone on a fixed income who also suffers from health complications, his top priority is to reduce his healthcare costs.

Currently, he doesn’t wear any device that collects his health data, and he doesn’t see value in sharing any data with his insurer beyond what’s required of him. For Tommy, reducing costs is the most important criterion for selecting a health insurance plan, but he believes sharing his data will negatively affect his premium. He wants to ensure that he has access to the care he needs without having to worry about high out-of-pocket costs and is looking for an insurer that can offer comprehensive coverage at an affordable price.

Food for thought:

How can insurers use data to meet the needs of individuals with higher health risks—namely, access to care, health management tools, and new products for these segments?

According to an ABI research report, 64% of general insurance customers “would prefer to see everyone pay for their insurance exactly according to their level of risk, even if it makes insurance unaffordable for some people.” How can insurers balance equitably supporting individuals with higher health risks while encouraging these segments to share their data?

Transparency and customer-centric digital interactions: Top two priorities to incentivize customers to share fitness tracker data

In the coming years, health insurance companies are expected to integrate the collection of fitness tracker data into their business models to create benefits for both insurers and customers. However, as highlighted earlier, each buyer has unique priorities, and recent research by ValuePenguin in 2022 reveals that while many Americans are enthusiastic about the idea of wearing a fitness tracker to obtain a health insurance discount (69%), there is also a significant level of skepticism (only 35% of those who would wear a fitness tracker to obtain a discount would share the data with their insurer). In that context, transparency and empathetic digital interactions become two top priorities.

Transparency

People want to feel like they have control over their personal data. Health insurers must allow customers to make informed decisions based on:

- How their data will be used

- Premium considerations

- Health management tips

- Marketing, new product development, and public health data

- How their data will be protected

- Data anonymization

- Access management

- Cybersecurity policies and procedures

- Data opt-in and opt-out options that clearly communicate the benefits and disadvantages of doing so

Empathetic digital interactions

As health insurers transition to increasingly digital operations, the emphasis on AI and self-service digital channels has grown, with fewer agents being utilized. While this shift undoubtedly offers operational and cost efficiencies, it’s important not to overlook the essential human element. After all, moving from a transactional to a relational business model necessitates building long-term relationships that benefit both parties. How can insurers enhance customer-centric interactions and build empathy into every touchpoint in an increasingly digital insurance landscape?

- Deliver personalized notifications that inform customers of possible health issues based on wearables data.

- Offer personalized action plans to improve health outcomes. This case study is an example of how a company with AI and analytics capabilities helped a client in the health insurance domain develop a health recommendation engine.

- Provide incentives to encourage healthy habits and stay within recommended health thresholds. According to ValuePenguin’s 2022 report, survey respondents believe discounts should be given for the following categories:

- The recommended amount of daily steps (24%)

- The recommended amount of exercise (27%)

- Meditation app users (30%)

- Nutrition intake tracking (26%)

- Offer lifestyle-based deals and discounts through partnerships with fitness clubs, fitness product retailers, vitamin and supplement retailers, pharmacies, health and wellness classes, and more. An example of this is Cigna Healthy Rewards Incentive, a program that allows customers to save money on several health and wellness services with participating providers.

- Reward customers for successfully achieving daily, weekly, and monthly goals. An example notification sent to a customer’s phone may say, “Congrats! You hit 10,000 steps 25/30 days this month. Pick one of our partner reward offers.”

- Provide fitness tracker reimbursement or discount programs, such as Blue365, a BlueCross BlueShield program that can save customers up to 33% on Fitbit devices.

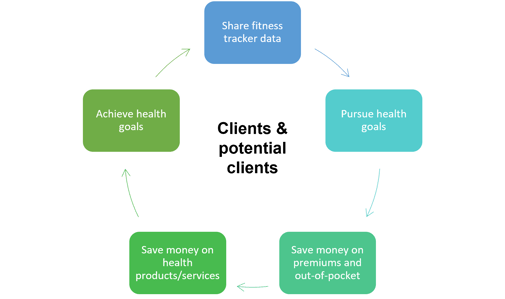

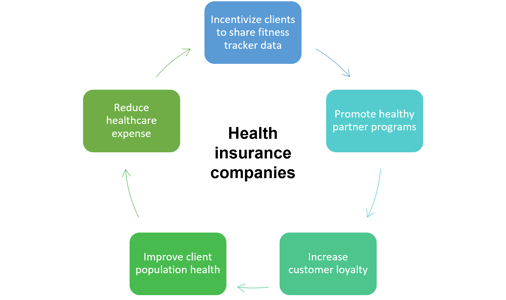

Win-win situations for clients and health insurers regarding fitness tracker data:

Becoming a data-driven health insurer

A strong data practice is crucial for health insurance organizations looking to enhance their customer experience, increase efficiency, and personalize the buyer journey. While fitness tracker data is valuable, relying solely on this source is insufficient. A robust data analytics foundation is necessary to ingest data from various sources, including social listening, sentiment analysis, public health data, market research, electronic health records, and wearable devices. This data can inform key business decisions, such as usage-based insurance, risk assessment, customer retention, acquisition, and fraud prevention and detection.

To achieve a strong data practice, companies need to focus on several key components. These include data strategy, infrastructure, collection and storage, analytics and visualization, governance and compliance, data science and AI, and data culture.

Traditional insurance companies may face challenges in making the most of available data due to outdated technology systems and processes. To overcome these challenges, they can engage with technology partners to transform their digital environment, navigate a complex regulatory landscape, and define use cases that support business model evolution. On the other hand, Insurtech and other digitally native health insurance companies may already have strong data practices and digital channels, but scaling them could be a challenge. Technology partners can provide access to technology talent, enhance digital security and compliance, and enable agile project management to guide the process.

As health insurance companies improve their analytics capabilities, they can create additional revenue streams. They may monetize data by offering consulting, analytics, and insights to other companies or partnering with/acquiring other companies to turn their data platforms into revenue engines. They may also invest in digital twins to run simulations to validate their prescriptive analytics. In conclusion, a robust data practice is vital for health insurance companies to remain competitive, offer personalized services, and create value for their customers.

Conclusion

As the industry becomes increasingly digital, health insurance providers must incentivize the sharing of data and prove to customers that it’s safe and beneficial to do so. Enhanced data and robust data systems can provide optimal benefits for all parties involved, including insurers who can achieve better retention, acquisition, and cost savings, and customers who can enjoy improved health and save money.

Sue is a Business Relationship Manager for Softtek's Insurance vertical with more than 25 years of experience in the industry supporting leading insurance companies with their digital transformation. Visit Softtek's insurance page to connect with our experts and learn how we're revolutionizing the insurance industry.

.webp?width=352&name=DALL%C2%B7E%202025-01-02%2014.57.14%20-%20A%20highly%20abstract%2c%20minimalistic%2c%20and%20illustrative%20painting%20inspired%20by%20the%20fusion%20of%20the%20insurance%20industry%20and%20tech%20innovation.%20The%20scene%20conveys%20a%20f%20(1).webp)