The bright future of mobile payment technology

Mobile payment technology has continued to evolve around the world. It is a hot topic in a number of industries, including retail, hospitality, financial and others. The future of this technology is truly bright, as it changes the way consumers buy their products and request their services.

It is expected that by 2024 up to 4 billion users will have mobile wallets, a fairly significant growth compared to today’s 2.3 billion users. In addition, mobile money transactions are expected to reach $9 trillion per year by 2024.

These figures may even increase due to the impact that mobile payment technology is suffering from the Covid-19. This global crisis has forced people to change many of their daily habits, including being cautious to avoid getting infected, and mobile payments are a perfect tool to avoid this.

The unstoppable growth of mobile payments

It is true that for a long time payments with NFC did not convince users, who have preferred to pay with contactless cards because of their accessibility and the vision they had of mobile payments as something “futuristic”.

However, this view has changed with the arrival of the Covid-19 pandemic, and in recent months both mobile payments and contactless card payments have increased considerably, causing financial institutions to extend the contactless payment limit from EUR 20 to EUR 50, which has further encouraged people to use contactless payment rather than cash.

The mobile payments market was valued at USD 1,139.43 billion in 2019. Around 83% of shops and services worldwide are rapidly adopting and integrating physical POS for receiving mobile payments, in addition to dozens of mobile payment applications, such as PayPal, Samsung Pay, Apple Pay, AliPay and WeChat Pay, among others, to accept these payments. And due to changing consumer lifestyles, the widespread use of smartphones and the increasing growth of e-Commerce, this trend is expected to continue to increase over the next few years.

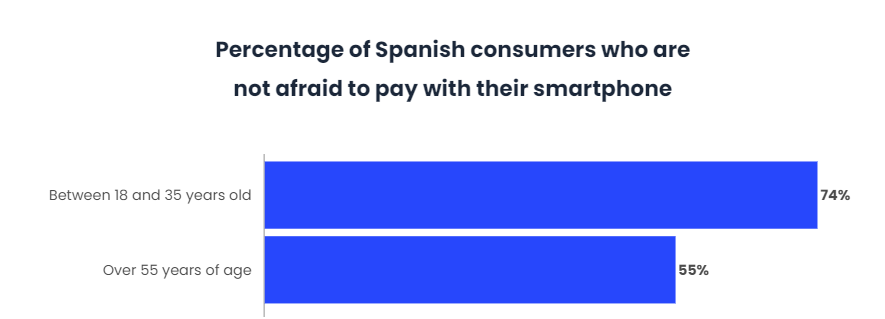

However, the increased use of mobile payments does not mean that cash payments will disappear or stop using, at least in the near future, and this is due, in part, to the fear that many users still have to pay through this method. In fact, in Spain, 74% of consumers between 18 and 35 years old are not afraid to pay with their smartphones, but only 55% of users over 55 years old would dare to make payments with their mobiles.

Growth factors

This exponential growth in mobile payment technology is attributed to several factors, including:

Security

Mobile payments are secure, as they do not require contact, and users avoid having to carry cash, or carry their credit cards, which can pose a threat.

Using this payment method, different technologies can be used, including NFC payments and different ‘wallets’ such as Android Pay, Google Pay, Apple Pay, among other highly secure wallets. These wallets come with very good quality microprocessors, are secure and reliable to keep all transactions and accounts safe.

Ease of use

With advanced technologies, the user can use a mobile payment application to make and complete transactions on the fly and at the same time. Therefore, it is a very simple, fast task, without any delay or inconvenience.

This is very attractive for both business people and customers because all they need is a smartphone to make or receive payments.

Helping to build customer loyalty

By using wallets, users can opt for more rewards, discounts or special offers linked to customer loyalty programmes that can be easily accessed through mobile payment applications.

The loyalty factor enhances the growth and bright future of mobile payment technology. Today, customers are more likely to use applications that allow them to access discounted offers on different products and services.

High demand for mPOS

The future of mobile payment technology is also driven by the high demand for mPOS (Mobile Point-of-Sale) technology. These are smartphones, tablets or wireless devices that perform the tasks of conventional POS, but can operate anywhere and without any kind of tethering.

This offers the freedom to make or receive payments without using in-store payment systems. This is ideal, for example, for the organisation of trade fairs, food trucks, concerts and related businesses.

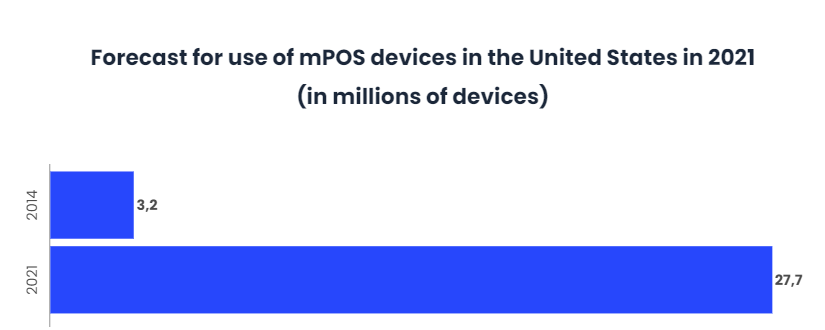

Mobile Point of Sale (mPOS) technology improves payment processes because it is flexible, and the devices or terminals used for this are portable and can be carried around without any problems. In the United States, up to 27.7 million devices are expected to be in use by 2021, compared to 3.2 million devices in use in 2014.

The rise of biometric authentication

Whether unlocking the smartphone with the fingerprint, or the laptop with the facial data, the vast majority of users have made use of biometrics and feel safe with this technology.

Mobile wallets are secure mobile payment systems thanks to the advanced biometric authentication process they have. It is the perfect solution to the problem of identity theft and fraud associated with cash payments.

It is a reliable way of identifying, for example, who is the owner of an account, or in an organisation it is easier to identify employees and thus prevent anyone from receiving undue payments. It is estimated that by 2021, 18 billion biometric transactions will take place.

AI growth

Artificial Intelligence is increasingly improving the quality of mobile payment technology. It is a trend that will also grow to allow more and more customers to make their purchases from different AI devices, such as Amazon’s Alexa.

The technology will also be used to ensure a fraud detection system and to provide quality protection against cyber attacks.

Growth in paid apps

Today, mobile applications are increasingly popular. Customers can easily download Mobile Wallet applications to their devices and smartphones. With this type of application, users can pay for products and services without fear of losing their money.

Reduced use of physical cards

The growth of Mobile Wallets has seen a reduction in the use of physical cards. Although these cards are still the most widely used payment method in many countries, the increased use of mobile payments is leading to a reduction in card usage.

Mobile payment applications and some of the most popular digital payment options are efficient, reliable and secure. Therefore, they reduce the need for the use of physical cards in different environments.

Other methods of payment: Crypto-currencies

As both consumers and retailers have to adapt quickly to an environment where cash is suddenly no longer king, the adoption of alternative payment methods such as mobile payments is starting to accelerate. But this is not the only payment method that has started to grow in recent months, the use of crypto-currencies for contactless payments is also starting to increase.

Some time ago, it was possible to see how Amazon incorporated a direct system for paying with cryptomonies. Recently PayPal is considering the direct sale of active crypto along with custodial services of the same. These same speculations are circulating around Venmo who, likewise, would be looking at entering the cryptographic assets sector.

On the other hand, in Switzerland, one region plans to accept the use of Bitcoin and Ethereum crypto-currencies for users to pay taxes from February 2021. The crypto coin sector has been seeing a significant increase in demand for some time now.

Does this mean that the adoption of payments with crypto currencies will become widespread throughout the world? It seems not, or at least not in the near future, and this is mainly due to the lack of clarity that exists about the legal and fiscal treatment that would be required for a widespread use of Blockchain-based payments to take place. On the other hand, there are also doubts about the ability of merchants to manage the risks to the exchange of value that the use of such crypto-payments would have.

In addition, price volatility remains a major concern for large companies and they have not seen the acceptance of Bitcoin or Ethereum as a means of payment. However, we should not forget the important advances being made in the field of Stablecoins, which in the long term could change this perception.

Conclusions

The change in consumer habits with regard to cash is already a reality after the Covid-19 and everything suggests that it is a trend that will remain for good, at least among a significant part of users.

Other factors such as technological infrastructure, the potential of the e-commerce market or demographics are determining variables for the evolution of society towards a cashless model.

Companies are investing heavily in mobile payment technology because of the significant growth of the industry. In addition, many governments are also encouraging banks to build infrastructure to enable secure mobile payments in rural areas, which is a great opportunity for providers.

With these trends, the future of mobile technology is bright. From mPOS, biometrics, AI, to Mobile Wallets, more automated payment options and capabilities can be expected.