The 70% value of Blockchain lies in the reduction of costs

Speculation about the value of Blockchain is very common, and a clear example of this is Bitcoin. It is not surprising as the market value of this cryptocurrency increased from less than 20 billion to more than $200 billion over the course of 2017. However, Bitcoin is only the first application of blockchain technology that has captured the attention of the government and industry.

The most telling thing is that large investments are being made in Blockchain. Venture-equity funds for Start-Ups Blockchain grew consistently to $1 billion in 2017.

Another example is the investments that the big companies in the technology sector are making. IBM has more than 1,000 employees and $200 million invested in the Internet of Things (IoT), which works with Blockchain.

However, despite this data, Blockchain remains an immature technology, with a market that is still incipient and a clear recipe for success that has not yet emerged. Therefore, it is important to ask the question how can companies determine whether there is a strategic value in Blockchain that justifies significant investments?

- Blockchain does not have to be an unintermediator to generate value, but to encourage allowed commercial applications.

- Blockchain’s short-term value will be prevalent in reducing costs before creating transformative business models.

- Blockchain is still three or five years away from feasibility at scale, mainly due to the difficulty of solving the paradox of “cooperation” to establish common standards.

With the right strategic approach, companies can start extracting value in the short term. The dominant “players” who can set their Blockchains as market solutions must invest now to win in the future.

Blockchain doesn’t need to be unintermediator to generate value

The benefits of reductions in the complexity and cost of transactions, as well as improvements in transparency and fraud controls, can be captured by existing institutions and multi-party transactions using a blockchain architecture.

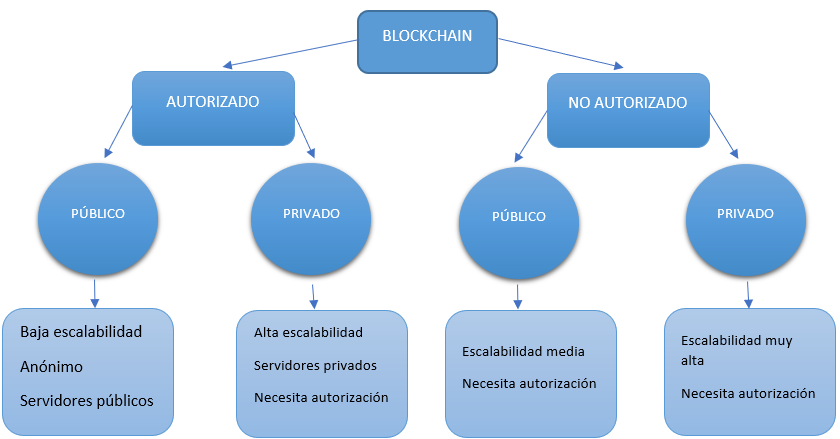

Economic incentives to capture value opportunities are driving those who are concerned with taking advantage of the blockchain rather than being outnumbered by it. Therefore, the business model that is most likely to succeed in the short term is the public Blockchain and not the private Blockchain. Public blockchains, such as Bitcoin, have no central authority and are considered enabling total disruptive. Authorized blockchains are hosted on private computer networks, with controlled access and editing rights.

A private and authorized Blockchain allows companies large and small to begin extracting commercial value from their implementation. Dominant players can maintain their positions as central authorities or join forces with other industry players to capture and share value. Participants can get the value of securely sharing data while automating control of what is shared, with whom, and when.

For all companies, authorized Blockchain enables the development of distinctive value propositions around commercial trust, with small-scale experimentation before expanding. One current case is Australian SecuritiesExchange, a exchange for which a blockchain system for stock compensation is being implemented with the aim of reducing back-office reconciliation work for its brokers.

IBM and Maersk Line, the world’s largest shipping company, have established a joint venture to bring a Blockchain trading platform to market. The goal of the platform is to provide users and stakeholders involved in transactions, a secure and real-time exchange of supply chain data and documentation.

If senior industry executives have already adapted their operating models to extract much of Blockchain’s value and, crucially, passed these benefits on to their consumers, then openness for new entrants will be small.

Cost reduction, short-term target

Blockchain could have the disruptive potential of being the foundation of new operating models, but its initial impact will be aimed at driving operational efficiencies. The cost can be removed from existing processes by deleting brokers or administratively using record-keeping and transaction matching.

This can lead to changing the flow of value by capturing lost revenue and creating new revenue for Blockchain service providers. According to a study by Mckinsey, the 70% value of Blockchain, refers to cost reduction, followed by income generation and capital relief. The fundamental functions of certain industries are intrinsically more suitable for blockchain solutions, such as financial services, government and healthcare.

- Financial services

The basic functions of financial verification and transfer financial information and asset transfer services are closely aligned with Blockchain’s central transformative impact.

The main current weaknesses, particularly in cross-border payments and trade finance, can be solved by Blockchain-based solutions, which reduce the number of intermediaries needed and are geographically Independent. Additional savings can be made in post-trading settlement in capital markets and regulatory reports.

These value opportunities are reflected in the fact that approximately 90% of Australia’s leading, European and North American banks are already experiencing or investing in Blockchain.

- Governments

Blockchain infrastructure can enable governments to perform registration and verification functions to achieve large administrative savings. Public data is often hidden and opaque among government agencies and between businesses, citizens and vigilantes.

By treating birth certificate data to taxes, Blockchain-based records and smart contracts can simplify interactions with citizens while increasing data security. Many public sector applications, such as Blockchain-based identity registrations, would serve as key solutions and standards for the overall economy. More than 25 governments are actively running Blockchain pilots supported by start-ups.

An example of how Blockchain technology can be implemented in the usual tasks of a government is that carried out by Estonia, a country that has a system called “Keyless Signature Infrastructure” (KSI) since 2012. Estonia implemented this Guardtime system in response to cyberattacks in 2007.

But GuardTime is not the only organization experimenting with the potential of blockchain solutions for government problems. Fluence, a startup that develops Blockchain database technology, sees great potential to improve trust among government departments.

- Health care

Within healthcare, blockchain could be the key to unlocking the value of data availability and exchange between providers, patients, insurers and researchers. Blockchain-based health care records can not only facilitate greater administrative efficiency, but also give researchers access to historical, non-patient-identifiable data sets crucial to advances in medical research.

Smart contracts could give patients more control over their data and even the ability to market access to data. For example, patients may charge pharmaceutical companies for accessing or using their data in drug research.

Blockchain is also combining with IoT sensors to ensure cold chain integrity (low temperature storage and distribution logistics) for medicines, blood and organs. In this sector one of the startups that is located within the Disruptive program, of Sanitas, is Intervitas, which works on the development of a mobile application with which the user will be able to have all his integrated clinical information, regardless of the medical center. The patient may share or grant access to his/her medical history to any physician under Blockchain technology and compatible with the GPRD, giving the power to the user.

Over time, blockchain’s value will change from driving cost reduction to enabling entirely new business models and revenue streams. One of the most promising and transformative use cases is the creation of a distributed and secure digital identity, both for the identity of the consumer and for the business process known as its customer, and the services associated with it. However, the new business models this would create are a longer-term possibility due to current feasibility constraints.

Three to five years to get real value

Blockchain’s strategic value will only be real if commercially viable solutions can be implemented at scale. The four key factors that determine the feasibility of a use case in a given industry are: standards and regulations, technology, assets and ecosystems.

COMMON STANDARDS ARE INDISPENSABLE

The lack of common standards and clear regulations is a major limitation in the scalability of Blockchain applications. Standards can be set with relative ease if there is a single dominant player or a government agency that can demand legal status.

When multi-player cooperation is needed, setting such standards becomes more complex, but also more essential. Industry consortia have already made significant progress, as seen by the R3 consortium of more than 70 global banks that collaborated to develop the financial grade Corda open source chain platform. Such platforms could set the common standards required for Blockchain systems.

TECHNOLOGICAL ADVANCEMENT MUST NOT BE STOPPED

The relative immaturity of Blockchain technology is a limitation to its current viability. The misconception that blockchain is not viable at scale due to its energy consumption and transaction speed is a combination of Bitcoin with blockchain, that is, a misconception.

In fact, technical configurations are a series of design choices in which you can select the speed levers (block size), security (consensus protocol) and storage (number of notaries) to make the most cases of commercially feasible use.

As an example, health records in Estonia are still in “out-of-chain” databases (i.e. not stored in Blockchain), but blockchain is used to identify, connect and control these health records, as well as who can access and control these health records, as well as who can access and control Modify. These offsets mean that blockchain performance might be lower than optimal than traditional databases at this stage.

The immaturity of Blockchain technology also increases switching costs, which are considerable given all other system components. Organizations need a reliable business solution, particularly because most cost benefits won’t be realized until older systems are retired.

Today, few start-ups have sufficient credibility and technological stability for large-scale government or industrial deployment. Major technology players are positioning themselves strongly to address this gap with their own blockchain-as-a-service (BaaS) offerings in a model similar to cloud-based storage.

DIGITALIZED ASSETS

The asset type determines the feasibility of improving record or transaction maintenance through Blockchain and whether end-to-end solutions require the integration of other technologies. The key factor here is the potential for asset digitization, assets such as stocks, which are digitally recorded and processed, can be managed simply end-to-end in a blockchain system or integrated through interfaces application programming (API) with existing systems.

However, connecting and securing physical goods to a blockchain requires enabling technologies such as IoT and biometrics. This connection can be a vulnerability in the security of a blockchain ledger because, although the Blockchain registry can be immutable, the physical element or IoT sensor can be manipulated.

THE PARADOX OF COOPERATION

The nature of the ecosystem is the fourth key factor. The main advantage of Blockchain is the effect of the network, but while the potential benefits increase with the size of the network, so does the complexity of coordination.

Natural competitors must work together, and thus solve the cooperative paradox that is proving to be the most difficult element to solve on the road to adoption at scale. The problem is not to identify the network, or even gain initial acceptance, but to agree on governance decisions on how the system, data and investment will be targeted and managed. Overcoming this problem often requires a sponsor, such as a regulator or industry agency, to take the lead. In addition, it is essential that players’ strategic incentives are aligned, a task that can be particularly difficult in highly fragmented markets.

What is a good strategic approach like?

Emerging ideas suggest following a structured approach to answering classic questions of Blockchain’s business strategy.

- Where to compete

There are a lot of use cases for Blockchain; companies face a difficult task in deciding what opportunities to pursue. However, they can narrow down their options by adopting a structured approach through a lens of pragmatic skepticism.

The first step involves determining whether there is enough accessible value in play for a given use case. Companies can only avoid the trap of developing a solution without problems by rigorously researching the true pain points: frictions for customers that Blockchain could eliminate.

The identification of specific pain points enables granular analysis of potential business value within the limitations of the overall feasibility of the blockchain solution. The overall characteristics of the industry, as well as the experience and capabilities of a company will further influence this decision, as companies need to understand the nuances of all these components to decide which use case will generate a strong return on investment.

If a use case does not meet a minimum level of feasibility and potential performance, then companies do not even have to consider the second step of which Blockchain strategy to adopt.

- How to compete:

Once companies have identified promising use cases, they must develop their strategies based on their market positions in relation to their target use cases. Many of the feasibility factors already discussed are within a company’s sphere of influence; even technology and asset limitations can be managed through trade-offs and a number of design options to shape a viable solution.

A company’s optimal strategic approach to Blockchain will be defined primarily by the following two market factors, which are the least likely to affect:

- Market dominance: A player’s ability to influence key parts of a use case

- Regulatory standardization and barriers: the requirement for regulatory approvals or coordination in standards

These two factors are critical to determining an enterprise’s optimal strategic approach, as they are essential to achieving the required coordination. The value of Blockchain comes from network effects and interoperability, and all parties must agree on a common standard to realize this value, multiple Blockchains in silos provide little advantage over multiple databases in silos. As the technology develops, a market standard will emerge, and investments in the non-dominant standard will be lost.

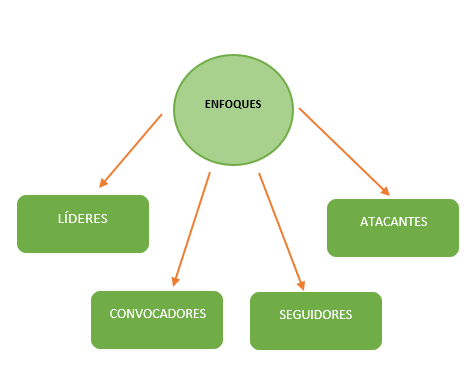

This consideration of a company’s market position will inform which of the four different strategic approaches to blockchain should be implemented and, in fact, further refine what type of use cases to focus on first.

- Leaders

Leaders must act now to maintain their market positions and seize the opportunity to set industry standards. As dominant players pursuing use cases with fewer regulatory coordination and approval requirements, they can establish market solutions.

The biggest risk for these companies is inaction, which would make them miss the opportunity to strengthen their competitive advantages compared to their competitors. An example of a leader following this strategy is Change Healthcare, one of the largest independent healthcare IT companies in the United States, when it launched an enterprise-scale healthcare chain for processing and payment of Claims.

- The c onvocates

Conveners should guide the conversations and consortia that are setting the new standards that will disrupt their current businesses. Despite being the dominant players, they cannot carry direct adoption of Blockchain on their own, as they face major regulatory and standardization barriers. Instead, they can position themselves to shape and capture the value of new blockchain standards.

An example of a convener following this strategy is Toyota, whose Research Institute established the Blockchain Mobility Consortium with four global partners to focus on Blockchain solutions for critical autonomous vehicle accelerators: exchange of data, peer-to-peer transaction.

- Followers

Followers should also carefully consider and implement an appropriate Blockchain strategy. Most companies do not have the ability to influence all necessary parts, especially when Blockchain applications require high standardization or regulatory approval.

Just as companies have developed legal and risk frameworks for adopting cloud-based services, followers should focus on developing a strategy on how they will implement and deploy blockchain technology.

- Attackers

Attackers are often new entrants to the market without an existing market share to protect, so they must look for disruptive or transformative business models and Blockchain solutions.

Blockchain as a Service (BaaS) providers often adopt an attack strategy because they are selling services to industries they are not currently involved in. Companies pursuing an attack strategy often seek to partner with a dominant company in the market to leverage their leadership influence.

Conclusions

Blockchain has a strategic value for companies by enabling both cost reduction without disintermediation and the creation of new business models.

However, fundamental feasibility factors define what can be scaled and when, as well as realistic timelines for ROI as proofs of concept. Evaluating these factors will reveal the right strategic approach to where and how to compete to enable companies to start extracting value in the short term.