Servitization, a key concept in business models

Currently there is a situation in which, product-based business models are affected by the services-based business model. New skills are needed in a smart product world, and the success of innovation also depends on the effectiveness of a company’s open ecosystem.

Manufacturers are faced with a situation in which they must balance two aspects, on the one hand, the use of digital products so that legacy products reach the market faster, on the other hand, the investment in new smart products to capitalize on the opportunity to earn revenue from services.

Digital technologies are reshaping the manufacturing landscape, even when manufacturers are grappling with how to accelerate commercialization and develop new capabilities to customize their services. Brands are constantly faced with new challenges in the areas of innovation and product development. Product innovation has evolved from a closed circuit to an open ecosystem, requiring companies to explore forms of both internal and external collaboration.

Why is the transformation in product innovation important?

Most manufacturers recognize that keeping their business on the rise while encountering new sources of growth is a constant challenge. It’s difficult for companies to keep two different priorities in balance, such as accelerating the release time of legacy products and investing in smart, connected products.

In most sectors, organizations will still need to juggle both priorities. Despite efforts to make its range of connected products broader, its traditional products remain the main source of revenue. However, the opportunity to create valuable new sources for connected devices makes switching to a service-centric model an imperative.

It is important for organizations to focus on two areas:

- Restarting product innovation and development approaches by recognizing that legacy approaches do not ensure digital use throughout the lifecycle.

- Develop the capabilities needed to take advantage of the services offered (servitization), taking into account that open and widespread ecosystems are crucial to providing new value-added products and services end-to-end. And that customer data will help drive innovation, new products and develop innovative services.

Reboot required

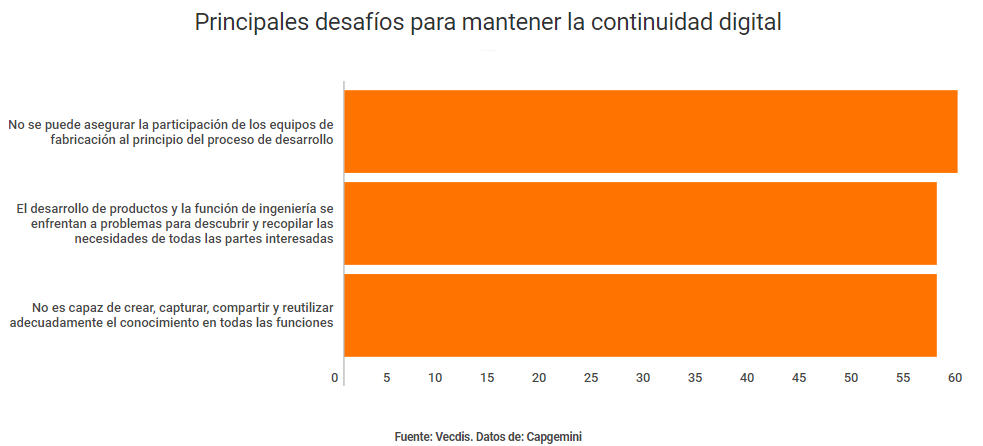

Current engineering processes are not supported for data exchange. The lack of integration between legacy systems restricts the effective extraction of data for product development and improvement. Six out of ten organizations cannot synchronize different activities at the beginning of the design and development stage, and the same number of organizations also find it difficult to create, access, and reuse information about how a product was designed, manufactured and repaired.

Servitization

According to research conducted by Capgemini, manufacturers expect nearly 50% of their products to be smart and connected products by 2020. This would represent a dramatic increase, since, in 2014, that figure was only 15%.

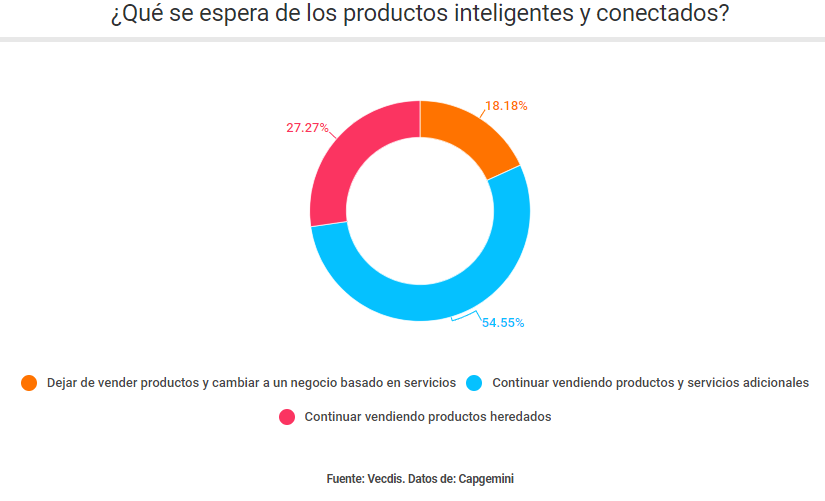

Smart, connected products offer a great opportunity for companies. About one in five manufacturers plan to seize this opportunity, an 18% plan to abandon the products and move to a service-based business model, about half (54%) planning to continue selling additional products and services. Antoine Destribats, VP of Industrial Operations at Schneider Electric says that:

“We want to bring value to the market by changing our business model, directing it to cloud-based service. It’s a key way to differentiate our market value from pure hardware players”

According to research from the Aston Business School, servitization presents an average annual growth potential of companies served between 5 and 10% in Spain.

For the service model to work, manufacturers need to fundamentally rethink how products are designed and developed, controlling two key areas:

- First, as products change to be powered by software, manufacturers must adapt to the demands of upgrade cycles.

- Second, manufacturers must capitalize on data generated by connected products if they want to sell services. However, conventional approaches to data aggregation, as well as sharing and analyzing data, are inadequate to extract the total value of data. For example, in a typical manufacturing configuration, the responsibility for storing and analyzing data usually lies with individual functions, with very little data shared between different departments.

How are they transforming?

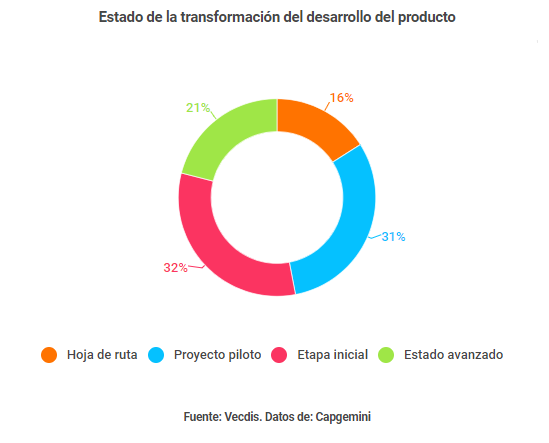

Few organizations are at an advanced stage when it comes to innovation. Most are at an early stage, only the 21% are characterized by being at an advanced stage.

No matter where each organization is on its path to transformation and innovation, everyone shows unequal progress in addressing two priorities: using digital tools or methodologies to accelerate and ensure the development of legacy products and the construction of critical services and product-service.

Digital tools and methodologies

The use of PLM (product lifecycle management) platforms and technologies such as digital twins, augmented reality, and virtual reality can make product development a more efficient and cost-effective process.

Around 50% manufacturers globally, aims to spend more than 100 million euros on PLM platforms and digital solutions, while the share of the IT budget to maintain legacy systems has declined significantly (from 76% in 2014 to 55% in 2017).

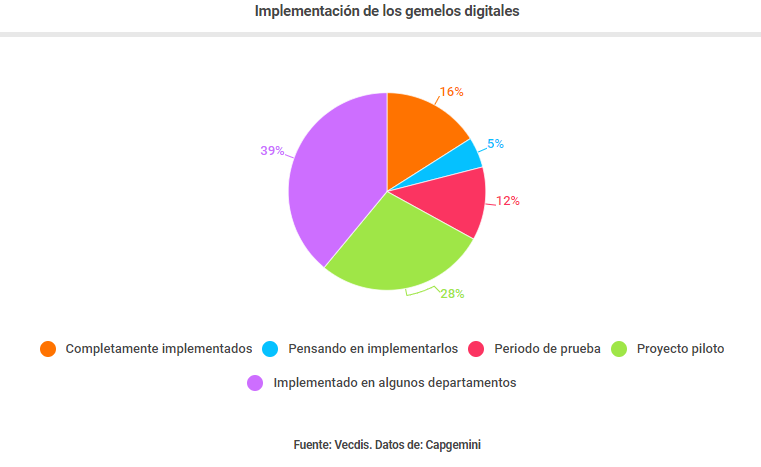

When you take a closer look at the use of different digital technologies, you can see that this enthusiasm for digital does not translate into real progress. For example, very few manufacturers are using all the features of a PLM platform, only the 16% has fully implemented the digital twins option, a 45% has only started a pilot phase.

On the other hand, manufacturers also lack the ability to use artificial intelligence (AI) technologies for product development and evaluation. For example, only about two out of five manufacturers use this technology to analyze customer communication across social networks and contact centers. This suggests that many manufacturers are missing the opportunity to use AI technologies to make design specifications and for product innovation.

Construction of services

As the service-based business model is adopted, manufacturers raise labor ecosystems in which to work “side by side” with partners, including start-ups.

Most organizations (54%) instituted programs to foster collaboration with new companies, third parties and suppliers. However, less than a third has used this type of program to co-develop products.

Despite the poor reception of these new working models, it is important for companies, who invest in them, as it will lead them to be able to boost both new investments in new services, and to find solutions to improve legacy products.

In addition, it is interesting that companies are considering a new culture of innovation, where it is easier for thoughts and experimentation to flourish. By adopting an open innovation strategy, organizations are able to secure the support of their community of suppliers, academics, or even their customers to solve key problems.

An example of this is “IAM 3D Hub or the International Advanced Manufacturing 3D”, housed in Barcelona, which is designed and built to be a one-stop shop for the industry, where to find a response to the needs that may arise in the path of adoption of the additive manufacturing.