Retailers late in adopting smart hardware

Artificial intelligence (AI) software has always received most of the attention, however, as the computational resources required to process this software skyrocket, a new generation of hardware is being created endowed with artificial intelligence.

Some experts have named this evolution “Cambrian explosion”, referring to the current period of fervent innovation. Today, AI’s range of innovative hardware accelerator architectures continues to expand. Although you tend to think that graphics processing units (GPUs) are the most advanced dominant AI hardware architecture, that’s far from true.

Over the past few years, both start-ups and established vendors have introduced an impressive generation of new hardware architectures optimized for machine learning, deep learning, natural language processing and other much more advanced Artificial Intelligence workloads.

Which sector will be the main adopter?

AI software has generally penetrated a multitude of areas, including banking and financial services, healthcare, retail, as well as media and entertainment. But who will be forced to implement new AI hardware?

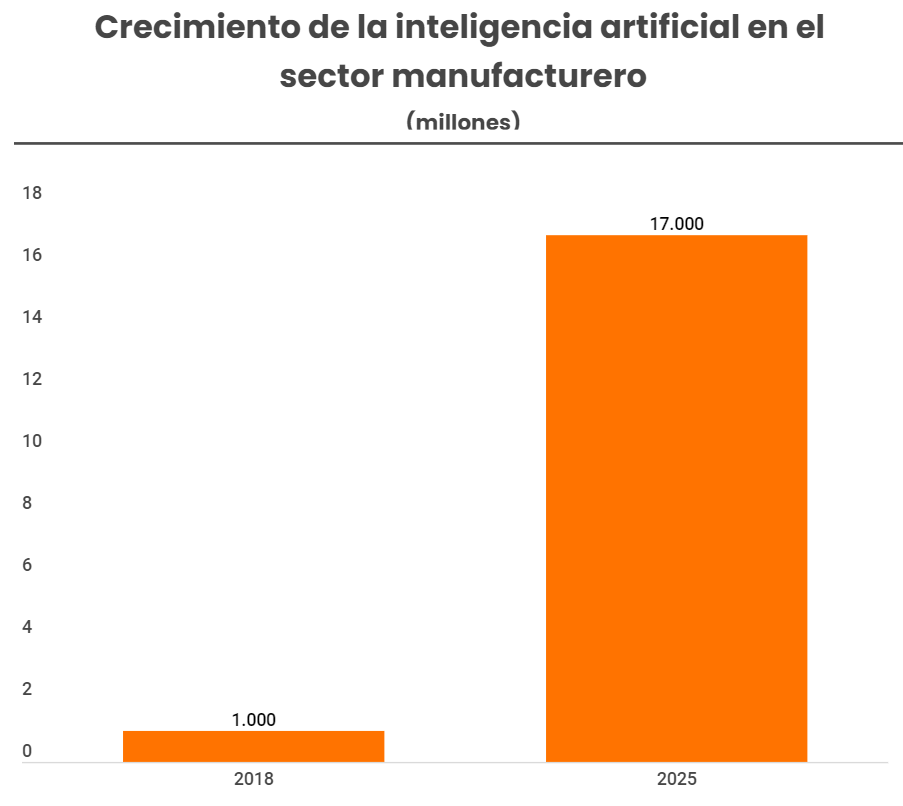

AI in the manufacturing market is expected to grow from $1 billion in 2018 to $17 billion by 2025. The enormous availability of big data and the increase in venture capital investments will be the main factors that will drive the growth of artificial intelligence in this market. In addition, the evolution of industrial IoT and automation will complement this growth.

For example, the Chinese company Hon Hai Precision Industry Co. replaced 60,000 factory workers with robots in 2016, suggesting that this high rate of adoption of industrial robots in manufacturing plants will drive the growth of AI in the market Manufacturing in the APAC area.

- High demand for high-computer processors

The growing need for hardware platforms with high computing power to run various artificial intelligence programs is the key factor that accelerates the growth of AI-equipped hardware devices in the manufacturing market.

The demand for high-computing processors to run AI algorithms will continue to increase steadily until 2025, specifically, GPUs are expected to grow strongly due to their high parallel computing capabilities.

- Increased use of machine learning

Machine learning’s ability to collect and manage large volumes of data and its uses in various manufacturing applications, such as predictive analytics and machine inspection, quality control, and cybersecurity are already driving their growth in the sector.

In addition, this technology is expected to account for most of the AI in the manufacturing market over the next five years. This is attributed to the huge availability of data, and the increase in adoption of LD by factories to improve productivity, reduce machine downtime and reduce operating costs.

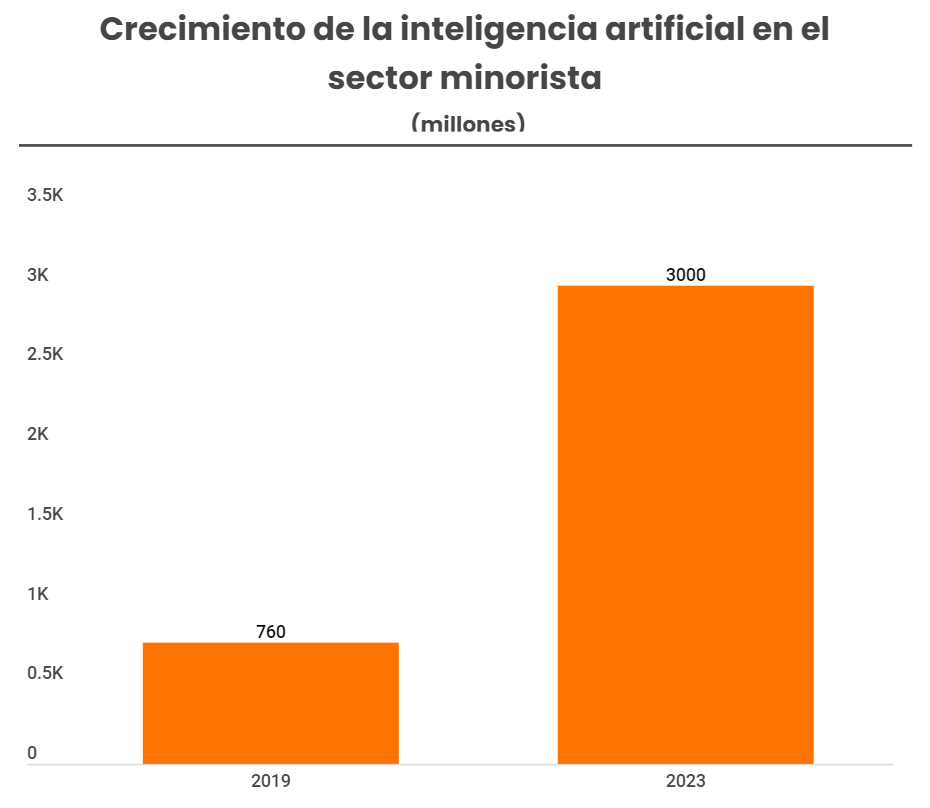

The use of this technology will play an essential role in anticipating the demand and the needs associated with this, enabling an effective design of omnichannel experience and widening profit margins. Revenue from services associated with this tool will rise from $760 million in 2019 to $3 billion in 2023, and retailers using demand forecasting functionality will triple.

Other key technology utilities will include the development of automated marketing and smart payment tools. In the latter area, the volume of annual transactions will exceed $1.4 billion, starting from $42 million in 2019.

In September 2018, The US company Shell Global Solutions announced that it is expanding its work with Microsoft to help accelerate the transformation and innovation of the industry. Through this collaboration, Shell drives efficiency across the enterprise from drilling and extraction to employee empowerment and collaboration, as well as safety for its customers and employees.

As part of this agreement, Shell announced that it selected C3 IoT with Microsoft Azure as its Artificial Intelligence platform to enable and accelerate digital transformation on a global scale

- Predictive maintenance and machine inspection

Extensive use of machine learning and machine vision for machine inspection, industrial IoT installation, and the use of big data in manufacturing are the drivers of growth.

It is a regular and systematic application of AI, which guarantees the proper functioning of the equipment and reduces its rate of deterioration. Artificial intelligence technology in predictive maintenance and machine inspection includes examination, inspection, lubrication, testing, and periodic adjustment of equipment without prior knowledge of equipment failure.

Overall, US company Intel is among the market leaders in the design and manufacture of advanced integrated digital technology platforms. The company has a strong market presence, especially in the PC and data center market, and invests significantly in R&D, which has resulted in its strong position in the AI sector.

Over the past 2 years, Intel has significantly demonstrated its strong inorganic growth strategy. The acquisition of companies such as Saffron Technology, Altera, Nervana Systems, Movidius and Mobileye has further improved its AI product portfolio. As a result, Intel recently launched some of the leading products for artificial intelligence, machine learning, and neural networks.

Hardware software

As mentioned at the outset, until recently artificial intelligence software was the one that had received the most attention compared to the hardware, however, there is the option to combine both areas and obtain a solution with a strong innovative load.

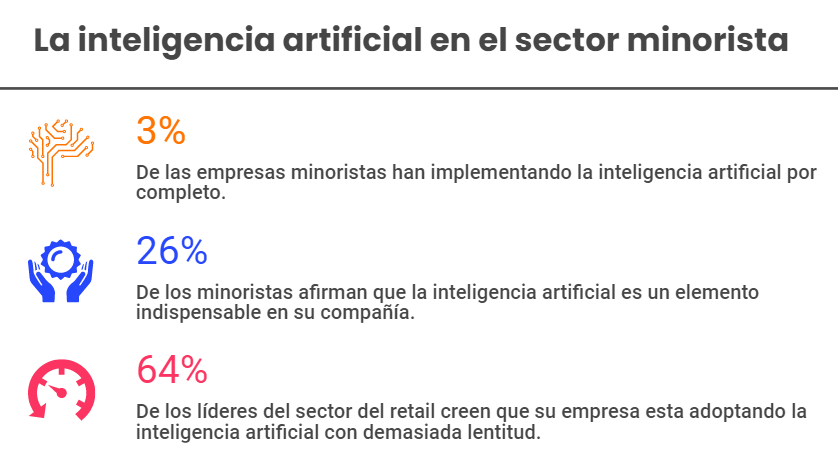

For example, in the retail sector, artificial intelligence is starting its way, according to the latest reports only 3% of the retail companies have fully implemented artificial intelligence, while the 26% states that it has already become a important part of your business. Although, most retailers (64%) are considered slow in implementing the technology.

Lowe’s retail company, specializing in home improvements, has experimented with several aia-driven projects throughout its history.

Its autonomous robot LoweBot, launched as a pilot program in 2017, was able to answer basic questions and guide customers and employees through the store. In addition to tracking inventory in real time and detecting sales patterns that could guide business decisions.

Currently, the company is taking some of the technologies from that experiment, computer vision, for example, to locate gaps in inventory. And, recently, it has just launched a text-based customer service platform that will anticipate what a customer wants and pass it on to workers. All of this allows Lowe’s employees to devote their attention to more complex human problems.

LoweBot and many other retail aimus technologies emerged from Lowe’s Innovation Labs, which are also working on technologies such as augmented/virtual reality visualization and a virtual reality store based in applications (the first of its kind), where customers can see how the products will look in their homes.

An example of the company’s approach to retail visualization is its test drive of Holoroom, a fully immersive VR experience that allows customers to test energy equipment in a much more realistic virtual way. This tool won the Auggie Award for Best Business Solution in 2018.

Conclusions

The artificial intelligence revolution has given industries the greatest opportunity to generate value it has had in decades. Hardware can be the differentiator that determines whether cutting-edge applications come to market and capture attention.

As AI advances, hardware requirements will change to compute, memory, storage, or networking, resulting in different demand patterns.

The best companies will understand these trends and look for innovations that help take AI hardware to a new level. In addition to benefiting your results, they will also be a driving force behind the AI applications that are transforming our world.