Life Sciences 4.0: a new model for e-Health

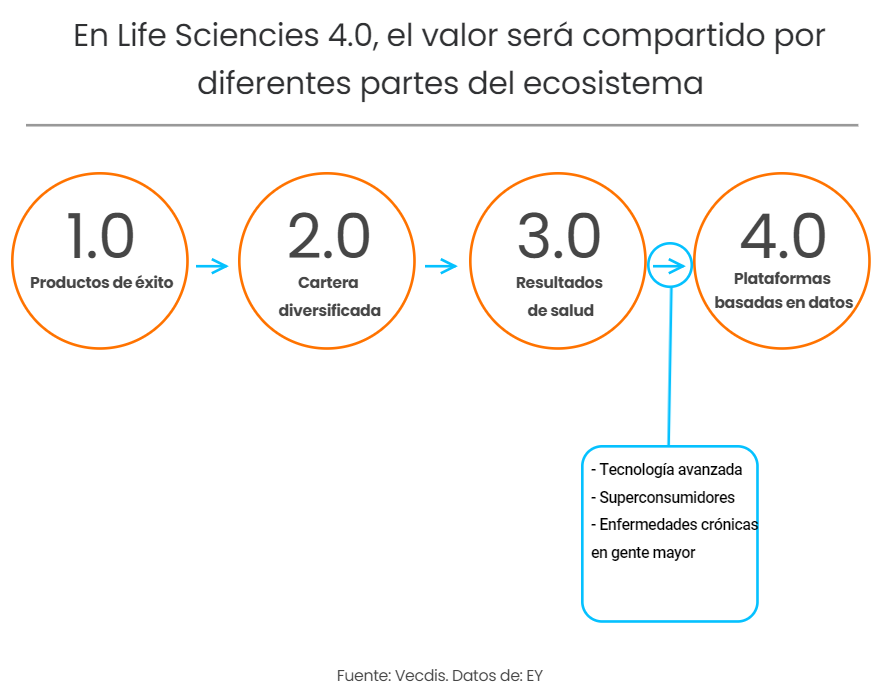

Currently companies that develop products and services for healthcare are data companies and can therefore be considered as technology companies. Similarly, every technology company that has access to consumer-generated health-related information is itself a health care organization.

The ubiquity of mobile tools and peer-to-peer exchanges is transforming consumers into “super consumers.” And, as these “super consumers” find engaging experiences in other areas of their lives, they demand similar interactions in the health ecosystem. Which makes consumers the center of this market paradigm.

Health science companies have already begun to respond to this new demand-driven environment, moving toward results-based business models. Therefore, they should now consider how to participate in emerging health care platformsthat seamlessly collect, combine, and share a variety of real-time health data.

To succeed, they must form agile partnerships and collaborations with a wide variety of stakeholders, including investors, suppliers, politicians, technology companies and digital retailers. Together, they form a platform- and data-based business model known as Life Sciences 4.0.

Why are platforms essential?

As new technologies allow people to view and share their health data, it also causes users to demand greater participation in their medical journey, as well as new products and services.

And that’s when digital health and technology operators have begun to move to meet consumer demands. The rise of disease-specific solutions is slowly being added to integrated systems that create attractive, high-contact offerings. In this ever-evolving world, health science companies should consider how they will adapt their current business models to create value in the future.

To succeed in this new environment, healthcare companies need new ways to securely and quickly access different data sources to combine and connect them to their own clinical and scientific data. Platforms, interfaces that promote the exchange of information between new and existing stakeholders, are one way to do this.

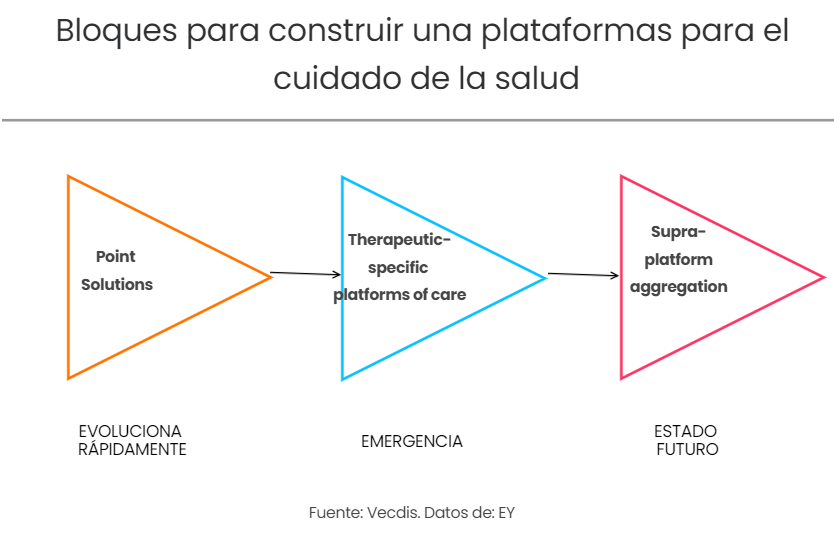

In health, the capabilities of the platform are emerging at two different levels. Regarding consumers, companies that develop different applications, products or tools will join forces to create customer service platforms that address specific health needs. And on top of these individual platforms of attention, global technology, artificial intelligence and data analytics, companies will combine their skills to become “super-platforms aggregation”,which will help expand the information obtained from the care platform across multiple therapeutic areas.

How do these platforms help?

New digital health companies and technology industry leaders are using their engineering and data analytics expertise to create new products and services that meet consumer and medical demands.

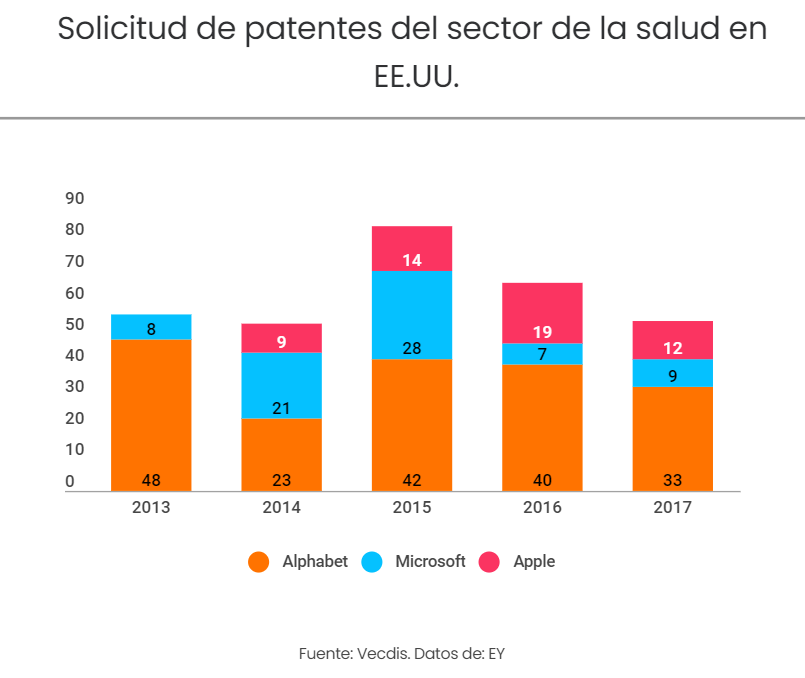

According to a U.S. health patent analysis. presented by major tech market players, shows how technology giants are investing in the health care sector.

Sanofi and Alphabet teamed up to create the ondual joint venture Onduo, a virtual diabetes-oriented clinic. Microsoft has worked with the Novartis laboratory to develop devices used to fight chronic diseases.

In the case of Amazon, it has partnered with Berkshire Hathaway and JP Morgan Chase bank to create a technology-aided company and medical platform that will sway expensive health care in the United States.

Apple, for its part, has devoted much of its efforts to making the iPhone a true record of users’ health. Another example is HP, which works with giant Johnson & Johnson on 3D printing technology applied to health. On the other hand, Pfizer is aided by IBM’s Watson supercomputer for immunongology research. Even Chinese giant Alibaba has signed a partnership with GSK to offer online medical help on the human papilloma vaccine.

Companies specializing in health sciences have responded to this potential disruption with their own exploratory programs, using artificial intelligence (AI) and other digital tools to improve or optimize clinical trial recruitment, drug discovery, and interactions with payers and physicians.

These efforts are important. Because even the most important clinical advances face the possibility of lowering yields, as cost-conscious investors require evidence of real value. However, as health science companies expand their digital efforts, investments become independent of each other. As a result, companies risk underinvestment in the technologies that will transform their business models and generate significant front-line future returns.

It is not difficult to imagine the gain that companies could make by building or participating in platforms that manage to scale in a given disease area. Some health science companies may choose to develop and own their own platforms, while others will find ways to use digital platforms created by other companies.

How can companies participate in platforms?

Right now, welfare-focused care platforms, linked to the development of fitness and nutrition solutions, have already emerged, and the emergence of platforms to control chronic diseases such as diabetes and asthma.

Outside of these indications, there has been a proliferation of interesting but confusing technologies that do not integrate perfectly with each other. When platforms begin to reach the scale needed to transform health distribution, a significant shift in value generation can be seen.

Initially, multiple care platforms will be created for the same area of the disease or for similar purposes. Over time, leading platforms in specific disease categories will emerge as users gravitate toward platforms that provide greater value. As organizations develop data analytics capabilities, “supra-platforms aggregation” will connect data generated from disease-specific platforms to help people and health systems to achieve broader goals.

Collaborations should cover public and private entities and include health organizations, consumer products, technology and health sciences.

How will they accelerate health care?

Patient care platforms will not become a reality unless health science companies also partner with investors, providers and consumers to create a shared vision that is linked to the results Expect.

As care platforms become a more important part of the value to be achieved in the future, healthcare companies can deepen existing relationships using the data obtained.

They can help stakeholders achieve consumer care goals that include: increasing the quality of care, reducing the total cost of care, and, more importantly, improving overall long-term health outcomes.

Future models

Platforms can help accelerate alternative payment models that share risk with investors, doctors and consumers. To do this, health science companies must know three different models:

- Subscription-based: Subscription models allow consumers to pay a fixed amount, making the service more affordable. For doctors, subscription models allow them to spend more time with people with more complicated medical needs. Meanwhile, health science companies have new opportunities to develop services that improve drug adherence or make lasting behavioral changes.

- Based in the population: Population-based models pay a doctor or group of physicians a fixed amount for each enrolled person assigned to them over a defined period. The idea is to create incentives that standardize treatment protocols to provide the most cost-effective care for the largest number of people. Most biopharmaceutical or medical technology products are not included in payment models based on in the populationOrn because of the associated complexities defining the products and services to be included, but examples of diabetes and end-stage kidney disease deserve to be addressed

- Pay-as-you-live: A recent trend in the insurance market is the rise of Pay-as-you-live (PAYL) models that reward customers for adopting healthy behaviors. In exchange for providing data to the insurer through portable devices or mobile phones, consumers with lower premiums and customized solutions are encouraged to make long-term changes that reduce the risk of disease Chronic. While most current PAYL models are linked to well-being, they could adapt to disease treatment and involve not only insurers, but also health science companies.

How to Get Approaching Life Sciences 4.0

In all industries, convergence has accelerated the turnover rate of Fortune 500 companies. According to EY forecasts, between 47% and 81% of fortune 500 companies could be new by 2023. The implications for the 18 health care science companies listed in the Fortune 500 are significant: only four could be available by 2023.

Although many health professionals question the return on investment associated with medical platforms, these interfaces are a way to take advantage of disruption in a transformative era. Because of their scientific and clinical knowledge, health science companies can play an important role in shaping user care platforms into robust, evidence-based interfaces that exponentially improve health outcomes.

As companies respond to customer demands, their share of total market value will change in ways that will depend on the business models they have chosen: advanced innovation, efficient products, lifestyle, etc.

To be successful, companies must consciously invest in both skills and intellectual property to align with their business models. If companies decide to change business models, they must also understand the time, money and talent investment needed.

The future of the business

Convergence will create new business models and new opportunities for health science companies to capture value. In fact, traditional models can change, merge, or disappear completely as a result of growing customer expectations and technological changes.

In the future, healthcare companies will be able to better use the data obtained to understand the changing market landscape and predict how changing user needs directly affect the future value they can create.

Companies in the industry have a limited opportunity to accept and participate in the development of customer service platforms. In doing so, companies not only gain direct access to customers, but also build trust by working together with investors and physicians to improve the healthcare experience and consolidate their place as reliable contributors to the overall health ecosystem.