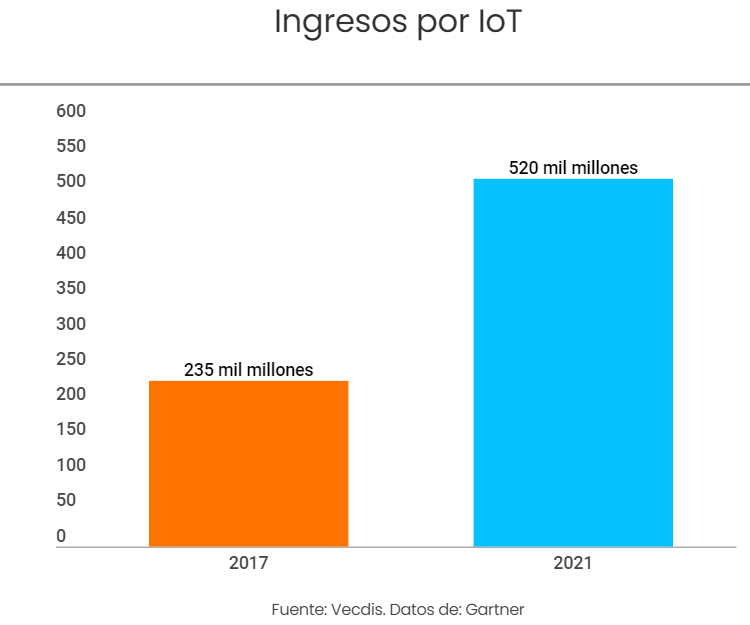

IoT market to grow to $520 billion by 2021

Entrepreneurs continue to invest in the Internet of Things, but their enthusiasm has been tempered by the realization that complete solutions can take longer to implement and produce high performance than originally expected.

Still, some analysts like Gartner predict that markets for IoT hardware, software, systems integration, and telecommunications and data services will grow to $520 billion by 2021, more than double the $235,000 million spent in 2017.

In the last two years, customers of IoT products have changed their providers of this technology, believe that they have made little progress in reducing the most important barriers to the adoption of oT, including security, ease of integration with information technology (IT) and operational technology, uncertain system and returns on investment.

Which means these customers have expanded their expectations of when those use cases will reach a good point in their organizations. On average, theyare planning less extensive IoT deployments by 2020 than they were planning just a couple of years ago.

Despite these concerns, business and industrial customers still see success at their fingertips. They still have more proof of concept than they did two years ago. And more customers are considering trying new use cases: 60% in 2018 compared to less than 40% in 2016.

Cloud services

Cloud service providers (CSPs) have become the most prominent and influential, not alike amazonian Amazon Web Services (AWS) and Microsoft Azure. CSPs are reducing barriers to IoT adoption, enabling simpler deployments and also making it easier to test new use cases and scale quickly.

However, its extensive horizontal services provide little optimization for industry-specific applications, leaving a significant opportunity for industry solutions from system integrators, developers of applications, IoT specialists, device manufacturers and telecommunications companies.

This demand represents a great opportunity for suppliers of this technology who can meet the needs of customers. A survey conducted by Bain & Company found that suppliers agree with customers’ concerns about some of the barriers that IoT (security, return on investment) faces, however, not so much about others ( integration, interoperability and data portability).

For this reason, the key to addressing these concerns lies in focusing on fewer industries in order to learn what customers really want and need. Gaining an in-depth experience in some cases helps suppliers anticipate customer needs and allows them to create a repeatable playbook and end-to-end solutions.

What changes will be made from now on?

The survey named above, I show that customers do not believe that CSPs and software providers of analysis and infrastructure are the ones with the greatest influence over the IoT solutions they are purchasing. Many customers see CSPs as leaders in providing easy access to IoT tools that collect, aggregate, select, and analyze data.

For example, AWS and Microsoft Azure have expanded their IoT-specific tools in the last 18 months. CSPs are leveraging their extensive analytics expertise to expand on IoT battlefields, as well as to strengthen their position on the analytical and cloud battlefield for business and industrial customers.

On the other hand Edge analytics have also become increasingly important as solution providers and customers realize that they can move processing power from the cloud and approach the sensors and cameras where the Data. Video surveillance, for example, is just one use where it might be more cost-effective to analyze data close to the source rather than sending bandwidth-intensive videos to the cloud.

Customers identified, in 2018, the same problems as 2016, security, integration with existing technology, and uncertain return on investment.

Safety concerns are particularly heavy. Research concludes that business customers would buy more IoT devices and pay more for them (approximately 22% more on average) if your security issues were addressed.

Integration also remains a barrier to overcoming. Suppliers have not made it easier for customers to integrate their IoT solutions into business or IT and OT processes, and may be underestimating their customers’ concerns. If vendors invest in learning more about typical deployment challenges in their customers’ industries, they can offer more complete end-to-end solutions.

Priorities also change. Predictive maintenance emerged as one of the first IoT usecases, as sensors and analytics helped companies more accurately determine when maintenance or replacement was needed.

Schindler, for example, worked with GE’s Predix platform to implement an extensive predictive maintenance program designed to optimize maintenance on more than 60,000 elevators and escalators worldwide. However, some interest in predictive maintenance has waned because customers found that returnon investment has taken longer than expected. Legacy data formats and missing historical data are part of the problem, and knowledge has been harder to obtain than promised.

Interest in remote monitoring, on the other hand, has increased because it tends to be an easily integrated or independent application. The industry equipment leader, ABB, for example, integrates remote monitoring into their connected robotics systems and connected low voltage networks, enabling customers to troubleshoot and quickly identify problems that require more Attention.

In all use cases, suppliers and their business customers are not always fully aligned. Customer interest in many IoT use cases has increased since 2016. Providers are somewhat more bearish because they prioritize their investments in the use cases that are being tested in the market, and that they can scale more efficiently.

Safety, a key point

Despite being a topic of concern, according to the report published by HTF Market Intelligence “Global Internet of Things (IoT) Security Market Report 2018”, because of the slowdown in global economic growth, the Internet of Things (IoT) security industry has also had some impact, yet maintained a relatively optimistic growth over the past four years.

The size of the Internet of Things (IoT) security market has experienced an average annual growth rate of 28.06% from $3 billion in 2014 to $6.3 billion in 2017. For this reason, analysts believe that, in the coming years, the size of the Internet of Things (IoT) security market will expand further, reaching $28.42 billion in 2022.

Despite the growth that will revolve around the security of IoT devices,executives in enduring goods, construction and construction, energy and utilities, financial services and technology will be the most likely expressing a significant level of concern has.

These concerns reflect industry realities, not just the perceptions of individual executives. In energy, for example, oil and gas producers rely on tens of thousands of IoT sensors and complex production control devices in their wells and drilling rigs. Energy companies use data from these IoT devices, which can exceed one terabyte in an average day, almost in real time, to adjust their operations and maintain strict security thresholds. Compromising the integrity or disrupting the flow of this data could lead to catastrophic damage.

Which path should be taken?

The coming years will be critical to the development of IoT markets as leaders continue to make a profit and expand their industry-specific offerings. Headlines that don’t move fast enough to meet customers’ needs are likely to be outdone by more agile competitors. Device manufacturers, in particular, risk software and analytics competitors capturing the value of solutions, leaving them to deliver lower-cost hardwarecomponents.

The right actions vary, of course, from the situation from one company to another. But three themes are almost universal for IoT vendors.

- Focus on the right industries.

Industry customization and smart packaging are emerging as keys tosuccess. Major suppliers target their solutions in fewer industries than before, a welcome change that will allow them to offer solutions that best fit customers’ needs.

They should continue to reduce their focus: more than 80% of the suppliers still target four or six industries, too many to build depth quickly. Focusing on two or three domains allows vendors to incorporate significant industry experience, providing a competitive advantage over more generic CSP offerings.

- Develop end-to-end solutions.

As vendors gain experience implementing IoT solutions in specific industries, they develop cost-effective end-to-end packages with partners, something shoppers have been clamoring for. Many IoT deployments require customization, usually based on industry application: more than 60% customers say the solutions they purchase have more than a 25% customization.

When vendors explore industry-specific use cases, they learn about the different data sets needed, the sensors that measure it, and how to process it for valuable insights. Of this, learn what is transferable to the next customer. They can then create standard packages, reducing customization requirements, shortening sales cycles, and increasing the likelihood of success.

Several companies are showing how to adapt technology to markets in this way through partnerships and acquisitions. IBM Watson, for example, develops proof-of-concept with customers and applies those lessons to develop industry playbooks that include multiple-use cases.

IBM Watson’s work concept with Samsung, for example, helped the next subsequent job with elevator company Kone and French rail operator SNCF. Verizon chose acquisitions as a way to gain extensive telematics experience, purchasing Hughes Telematics, Fleetmatics, Telogis and Movildata to boost their fleet management.

Major industrial automation providers are also exploring ways to reduce barriers for their customers and extend their systems to IoTmarkets. For example, Siemens Mindsphere is integrating its digital IoT twin software for customers who already run their product lifecycle management systems.

- It is important to prepare for promotion by removing barriers to adoption.

Customers and suppliers believe progress has been slower than they expected to overcome major barriers to adoption. However,suppliers have more experience with operational considerations today than two years ago, and customers have a better understanding of the necessary investments. Customers also have more realistic expectations about the returns they can expect.

Leaders will translate their expertise into repeatable playbooks that address their customers’ concerns about security, integration, and return on investment. Understanding customer weaknesses is the first step; addressing them and turning them into end-to-end solutions will position technology providers to deliver cost-effective IoT solutions that can scale.