The fluctuation of the wearables market is a topic of regular discussion among professionals in the sector. For some brands it is still unclear how they can adapt their marketing strategy to this increasingly booming technology.

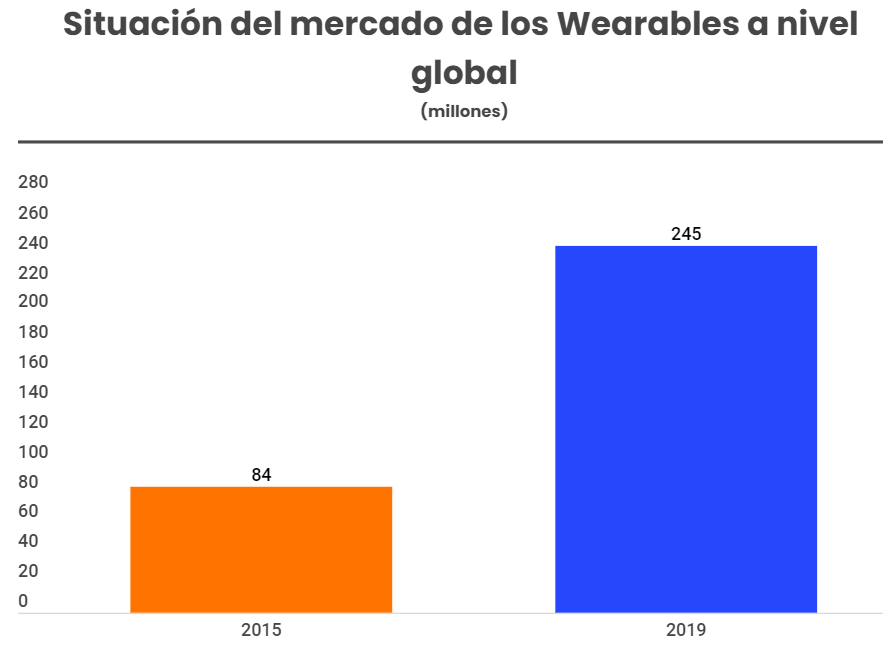

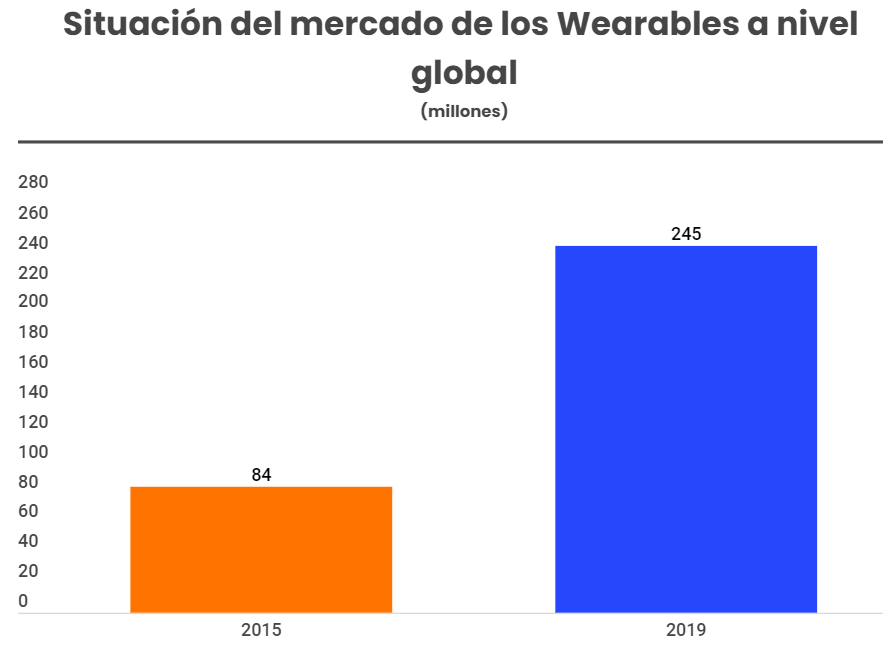

During 2018 the global wearables market reached a record, growing by 31.4% during the fourth quarter, the latest studies forecast that the market will reach 245 million units in 2019.

In addition, the market value is expected to triple over the next five years, reaching $25 billion globally. This forecast includes smartwatches, exercise trackers, virtual and augmented reality headsets and portable cameras, among others.

Sport sells

One lesson learned in the wearables market is that sport sells. Health and fitness tracking has been a staple of differentiation in consumer electronics over the past fifteen years, with examples such as iPods, classic-style watches, wearables and headphones.

While speed and distance tracking, among other measurements, has been integrated into smartphones or other sports-specific devices (such as computers built into bikes), wrist wearables are creating a new niche in certain sports.

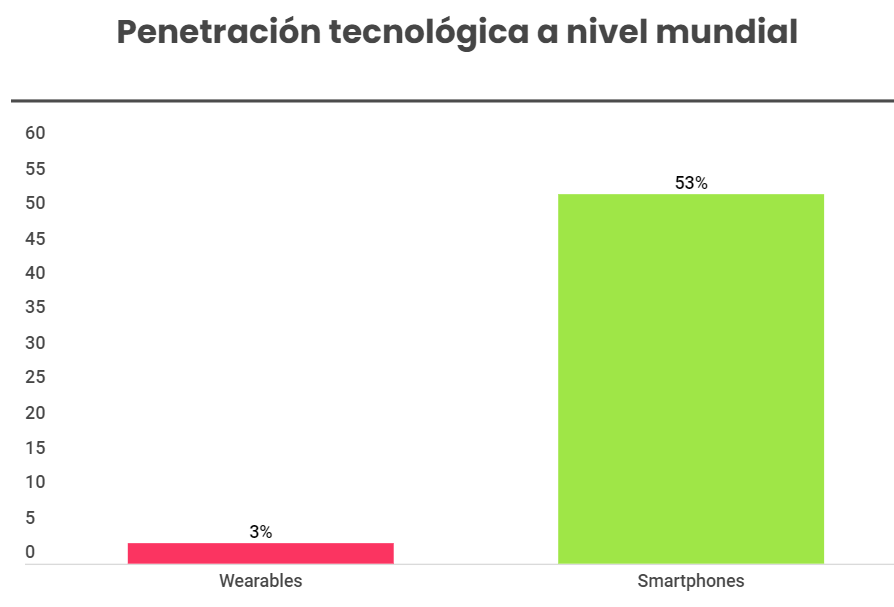

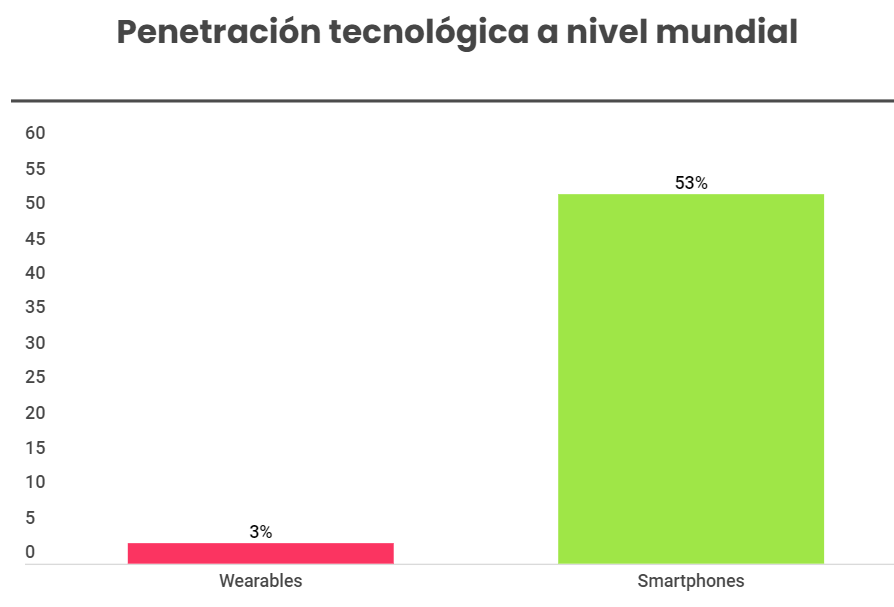

However, there is a long way to go, in 2018, wearables recorded a penetration in the population of 3%, compared to 53% belonging to smartphones. Therefore, for consumers to voluntarily use a device that allows for deep commitment to sports and health metrics, the wearable device must perform a function that other personal electronic devices cannot.

New software as the initial key

One of the main trends affecting the digital health and fitness market is the way software engages consumers. Software such as Strava, Nike Running Club or MapMyFitness has demonstrated the effectiveness of gamification to attract consumers with sports tracking.

The ability to track and review metrics for an exercise, see improvements, share progress, and compete with others has proven to be a compelling use case that better engages consumers with software and hardware, compared to exercise data stored offline for personal use only.

As consumer electronics spending begins to slow around the world, providers are looking for additional sources of revenue through service offerings, with data acquisition as a positive side effect of this.

The ability to delve into comprehensive sports metrics may be lost in most average consumers, but it underpins the business models of a number of virtualized training tools like Training or Peaks Trainerize, and of course it also assists in the medical study efforts of portable device vendors.

This data also helps in a variety of other areas. Strava, for example, can use its dataset to help with urban planning efforts in a data-driven world.

As consumers become more health conscious, and the reasons for owning a portable device become more compelling, then the potential wealth of data could inform a variety of industries, from sports and health clubs, even insurance and medical studies. However, GDPR and the ethical use of data will be a barrier for these industries, meaning that suppliers will need to provide a persuasive reason for consumers to give their data.

And what comes next?

As biomechanical feedback becomes the norm, the wearable will need to increase its range of action thanks to an expansive ecosystem of devices and sensors, ranging from connected ankles or trainers that provide feedback on muscle bands that track the effectiveness of a squat or dead weight, even swimming gloves.

For example, Opter Pose is a wearable that tracks and improves fitness, not only through sport, but also by improving posture, sleep or controlling exposure to ultraviolet rays. It aims to free the back from pain caused by uncomfortable positions, improve mood with natural light and safe posture, and track the user.

Despite their importance, other technology trends are likely to have as much impact on fitness technology as these sports-specific devices. Sports headsets, for example, accounted for 14% sales of headphones in 2018 and are expected to enjoy significant growth through 2023.

On the other hand, Extended Reality (XR) will also begin to be part of fitness technology, as for example swimming will benefit from live measurements that the wearable currently cannot provide, or cyclists who use display screens built into your lenses.

Collaboration, essential to success

So far there has been talk of new software and innovative technologies, however, there has been no need to create a solid link between the different vendors that should be part of the wearables.

These devices must be developed with an “identity” in mind that goes beyond a simple dataset. This ‘identity’ will evolve from the individualization and optimization of each user’s preferred habits and activities.

For a wearable to succeed, you need more than just a well-branded device and related app. The creative company must partner or collaborate with a set of specialized companies, with cloud analytics providers such as IBM Watson, Microsoft Azure, Google Cloud or Alibaba Cloud, and with some network operators that enable device connectivity or the private cloud environment in which it operates (e.g. Telefonica, Vodafone, Telstra,…).

For a sports brand, it might even be beneficial to analyze the market for a partnership with a healthcare provider, a biotechnology company, or a traditional medical technology company to accelerate time-to-market. Like Apple’s heart study.

Conclusions

As sports and health monitoring become more and more refined, the wearable will begin to detach itself from the smartphone, becoming a product worth taking ownership of.

The software is expected to continue to play an essential role within the user’s ecosystem and, while suppliers and manufacturers will attempt to integrate their products to create a need, although consumer choice will prevail.

The ‘digital fitness wave’ is still gaining momentum and has not yet peaked. However, forecasts suggest that wearable will be a product that will benefit from the introduction of technologies such as extended reality or artificial intelligence.