This electricity sector strategy could save wallets and ecosystems

Electricity is a unique kind of commodity— although it is not perishable, it is (still) hard to store on a large scale. Electricity must be generated relatively close to where it is demanded and at the time it is demanded. Therefore, operators must constantly keep an eye on the use of electricity. When demand is high, operators will signal the generators to increase their output; if less, generators get the instruction to generate less electricity. Roughly, this is how the grid works.

Time restraints

The devil is in the details: the flexibility of power plants is unique to its type. Nuclear and coal power plants take the longest to start up and shut down, followed by oil/diesel power plants. Combined cycle and gas are some of the fastest power plants to start up just behind hydro, which is among the fastest.

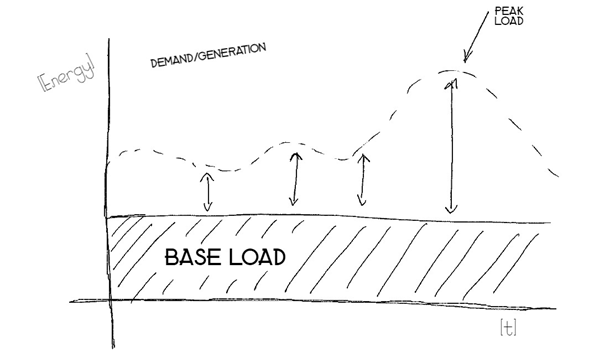

The inflexibility of nuclear and coal power plants means they must carry a fairly large and constant load. This is often called the base load, defined as “the minimum amount of electric power delivered or required over a given period at a constant rate.” The rest of the power plants must scramble to fulfill the variation in demand by starting up, shutting down, increasing and decreasing their output power.

Electricity market complexity

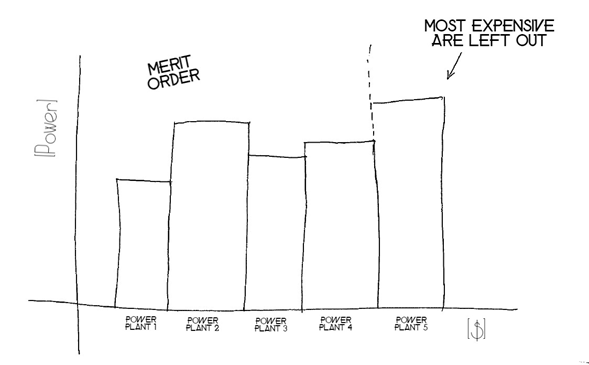

The way electricity markets work adds another layer of complexity. In a nutshell, the market operator receives buying and selling offers. The offers help them conclude how much energy will be available. The price of the energy is determined by the merit order, while the generator provides the operation costs (the price at which they are selling their electricity) and how much power they can provide in a period of time (15 minutes, 1 hour, a day) to the operator.

The operator finally gives dispatch orders to all the cheapest bidders that together total the amount of power needed for that period. In the graph below, Power Plants 1 through 4 will get paid the price that Power Plant 4 bid. Since the operator determined that the four cheapest power plants could provide sufficient energy, Power Plant 5 did not make the cut and was not dispatched (and will not get paid).

The challenge with renewables

Now let's consider renewables. These sources of electrical energy are:

- non-dispatchable (solar and wind power are reliant on adequate weather conditions)

- volatile (conditions change rapidly)

- hard to predict (we don’t know when the conditions will change)

Therefore, it’s not possible or there’s a big constraint to start-up at will.

These power plants normally get the first places (and make the most money) from the merit order since their operation costs are very low (no fuel and few personnel required) compared to conventional power plants. However, renewable energy sources aren’t an option to cover base load— the economic aspect forces the market to take in renewables while the non-dispatchability and the relatively low penetration of renewables limits its participation in the base load.

Storage, transport and distribution

Finally, transportation and distribution infrastructure need to withhold the large amount of energy being moved at peak hours, even if it’s only for a fraction of the day. For example, a transmission power line may have a capacity of 1000 MW, but only reaches its total capacity during peak hours, meaning the rest of the time it's not being used at full capacity. If peak load didn’t exist, construction of transmission and distribution lines could be optimized, making for better use of the resources. This would be achieved by having smaller and cheaper transmission and distribution lines that meet the average demand (which is lower than the peak load). This would also contribute to grid stability, as the lines would be pushed less often to its limits, reducing frequency of failures.

Clear constraints

We have some obvious constraints in the electricity market and grid operation:

- Certain power plants only run when demand is higher and shut down when the demand decreases. This leaves the more expensive, less efficient and often more polluting power plants operating during peak demand hours.

- Given substantial differences between base load and peak load, power plants and transmission/distribution lines are not being used at full capacity. This kind of infrastructure is a huge investment on the path to becoming a sunk cost, unless some additional capabilities enter the stage to help the electricity industry improve margins, satisfy investor criteria and do the planet a favor.

- Due to the intermittent nature of renewable sources, this cheap and clean route can't cover demand at all times, at least not until we find a competitive and viable means of storing our naturally and responsibly produced energy. It would seem the expensive and polluting power plants are a necessary evil for now.

For all these reasons, redundancy has been imperative to keeping the grid working. Having enough generation to cover for peak demand is still not enough. The system can’t afford to have an outage in a power plant; it would make the grid fail and potentially create massive blackouts. This is true for all steps (generation, transmission and distribution). At the end of the day, redundancy means bullet proofing the system and getting more investment.

Tackling peak demand

What if we could distribute peak demand throughout the whole day, exploiting the available and cheap renewable energy whenever possible? Several solutions have been proposed in order to “move” the demand by storing energy in various ways: cold or hot storage rooms, batteries, compressed air, pumping water in dams, etc. It makes economic sense to think about projects of that nature, but unfortunately, current energy storage offerings are unremarkable in their efficiency and are often too expensive for large-scale adoption.

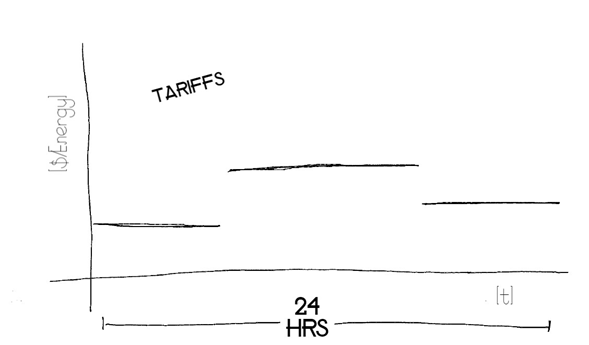

Time of use (TOU) tariffs are a way to incentivize the use of electricity at off-peak times (rather than trying to store it), achieved by making the electricity more expensive at peak hours and cheaper during off-peak hours. In the graph below, the most expensive tariff lies around the time the system operator expects the highest demand of electricity. This disincentivizes consumption at certain hours and might encourage it at lower demand periods.

Demand response

But what if we could further manipulate demand from the customer side?

Demand response is a strategy giving the consumer a choice regarding their electricity demand in exchange for better tariffs or other incentives. This can be achieved through real-time communication between generators, operators and users, and a certain degree of flexibility on the demand side. It may sound like TOU tariffs, but it’s not—it’s way more customized.

For example, suppose an operator detects a high output of solar and wind at a particular time. The customers then become informed of the available sustainable and cheap energy and consider starting appliances and operations that do not necessarily need to be running at all times, such as air conditioning, charging of electric vehicles, washing machines or dishwashers.

The opposite example may also be illustrative. Suppose the renewables output is low or there have been power plant outages, meaning the more expensive power plants are running. The demand side gets informed and might decide to shut down some operations and appliances in order to limit the impact of high electricity prices.

The importance of tech in demand response

In addition to the communication needed between generators, operators and users, automation and a deep understanding of demand-side processes are crucial.

It’s important to know the schedule and size of processes that cannot be interrupted. Cell towers, blast furnace operations, hospitals and other core operations often can’t afford to stop or even reduce the amount of energy they consume. Beyond the energy needs of core operations, the remaining energy use could arguably be modified.

The schedule of energy use must also be figured out. Having an idea of when cheap and expensive energy will be available, when energy intensive operations need to run, and a real-time status of the grid is important in order to make informed decisions.

Data for each of these aspects (core operations, demand-side intelligence, and energy use schedules) can be utilized by modern means. Big data and machine learning techniques can be used to turn the massive amounts of data generated into useful insights. Weather, electricity production, demand, market prices, and other data can be collected to build an algorithm that can help us make better decisions, keep the grid stable, maintain steady electricity prices, increase renewables integration and boost profitability across the industry. Artificial Intelligence (AI) and other types of information technology can then be used to predict changes in supply and demand in the electricity market by taking inputs from weather, historical data, etc. This would result in economic and environmental benefits for society.

Takeaways

- Demand response is not only a plausible solution, but a great starting point for the continuous incorporation of technology into an industry with increasingly pressing needs for digital transformation. Customers demand transparency in billing, consumption and environmental impact, while smart grids and a flexible operational core suited to embrace new technologies is necessary to meet these demands and boost the bottom line. It would be expected that sometime soon, demand response tariffs become commonplace for utility providers.

- A demand response strategy lessens the downsides of the electricity sector for customers too, who could enjoy cheaper electricity prices, more renewable energy integration, reliable access to power and reduced environmental impact. As electricity becomes more expensive and measuring devices become cheaper, the use of smart meters is a reliable way of keeping an eye on the demand, not only for electricity, but for every kind of commodity: water, natural gas, and other raw materials. These devices not only capture the measurement, but can also communicate with other devices and platforms. This brings more useful information to be analyzed in order to get a clearer view of what the client’s operation looks like.

- The amount of data necessary to execute a successful demand response strategy cannot be processed without a big data approach, making information technology is a fundamental part of the demand response solution. Some solutions have already arrived to the market, such as Softtek’s blauLabs, which obtains data from different sources (metering devices, market publications, enterprise resource planning software, CRM software and even sentiment analysis on social media, etc.) to concentrate, analyze and visualize it. Being a cloud-based solution, blauLabs provides speed, reliability, constant availability and computation power to make it an excellent fit for this type of application. Without machine learning and AI, the correlation and evaluation of all these variables would be a rough task; these tools aid stakeholders to make more educated decisions.

- When expertly implemented, the automation of certain processes is more reliable and less prone to errors, and can allow humans to focus on more meaningful work. This is a fundamental part of demand response, as it helps the implementation and subsequent continuation of demand response to be done right the first time.

- Around one fifth of the world’s greenhouse gas emissions can be adjudicated to electricity and heat. The energy sector is the perfect candidate for efforts to reduce carbon emissions. By enhancing the use of renewable energies and limiting the participation of polluting fuels while using innovative and technological approaches, such as the one described in the article, the sector can be a spearhead for this change. Our planet’s resources are limited, but a strong operational core capable of integrating new technologies into the energy industry can help us use them in a sustainable manner.

blauLabs is part of DIEGO, Softtek's portfolio of frameworks, platforms and products designed to help organizations propel forward in a world where digital is the new normal

.webp?width=352&name=DALL%C2%B7E%202025-03-03%2011.27.07%20-%20A%20minimalist%2c%20abstract%20digital%20painting%20of%20a%20padlock%20shattering%20into%20geometric%20shards%2c%20symbolizing%20the%20breaking%20of%20encryption.%20The%20composition%20is%20slee%20(1).webp)