By 2020 more than 20 billion devices will use Blockchain

In recent years, Blockchain has stood out as a revolution in business technology. In the nine years since its launch, companies, regulators and financial experts have spent countless hours exploring its potential. The resulting innovations have begun to reshape business processes, particularly in accounting and transactions.

In the midst of intense experimentation, the financial services industries to health and the arts have identified more than a hundred blockchain use cases. These range from new land records, to KYC applications and smart contracts that enable actions from product processing to stock exchange.

A sign of the perceived potential of blockchain are the large investments that are being made. Venture capital financing for new blockchain companies reached $1 billion in 2017. IBM has invested more than $200 million in a blockchain-driven data exchange solution for the Internet of Things and, Google has been working with blockchains since 2016.

There is a clear sense that blockchain is a potential technology for change. However, doubts are also emerging. One particular concern, given the amount of money and time spent, is that little major changes have been made.

Of the many use cases, a large number are still in the initial stage, while others are in development, but without results. The bottom line is that, despite billions of dollars of investment and nearly as many holders, evidence of practical and scalable use at the moment is scarce.

The initial stage

From a technological point of view, the path developed by the blockchain, is the usual. It is a technology that is at its most immature and is therefore unstable, expensive and complex.

Classical life cycle theory suggests that the evolution of any industry or product can be divided into four stages: start, growth, maturity and decline.

Despite its multiple applications, the blockchain remains stagnant in the first stage of the lifecycle (with a few exceptions). The vast majority of proofofs of concept (POC) are in the initial stage and many projects have been unable to reach the funding rounds.

One of the reasons for this lack of progress is the emergence of other technologies. For example, numerous fintechs are interrupting the blockchain scene. Last year, of the $12 billion invested in U.S. financial technology, the 60 focused on repayments and loans.

Having seen this competition, blockchain players in the payments segment, such as Ripple, are increasingly partnering with non-bank payment providers, whose businesses may be more suitable for this technology.

Coinone, a South Korean-based platform for cryptocurrency exchange has launched a blockchain-based remittance app called Cross, this app uses Ripple’s blockchain network, RippleNet, and is not based on traditional banking mechanisms. It offers payment services for people who wish to send money to Thailand and the Philippines. Allow people without banks or bank accounts to transfer money at low cost.

Given the range of alternative payment solutions and investment incentives for traditional operators, the question is not whether blockchain technology can provide an alternative, but whether it is necessary.

Industry caution

The early development of the blockchain was led by financial services, which from 2012 to 2015 allocated great resources for the implementation of this technology in various activities such as commercial financing, compensation and derivatives processing and compliance (along with payments).

Following in the wake of financial services, insurers saw the possibility of contracts and efficiency guarantees and the potential to share subscription and fraud information. The public sector observed how it could update its expanding networks, creating more transparent and accessible public records. Automakers viewed smart contracts over the blockchain to automate lease and lease severing agreements. And finally, others saw an opportunity to modernize accounting, hiring, and fractional ownership.

However, despite this great reception, financial services leaders in the past two have begun to have doubts. In fact, as other industries have been launched, financial services have become increasingly cautious, the fact is that billions of dollars have been invested, but almost no use cases can be implemented on a large scale.

On the other hand,the lack of a network dedicated exclusively to blockchain also creates uncertainty in different industries. The logic of blockchain is that information is shared, which requires cooperation between companies and heavy lifting to standardize data and systems. However, few companies have the appetite to lead the development of a utility that will benefit the entire industry.

The key question now is whether those doubts are still justified. Or if it’s just that progress in blockchain development has been slower than expected.

In recent months, some financial institutions have begun to recalibrate their blockchain strategies. They have put POCs under more intense scrutiny and have taken a more specific approach to financing development. Many have reduced their approach from dozens of use cases to one or two and have doubled in governance and compliance oversight, data standards, and network adoption.

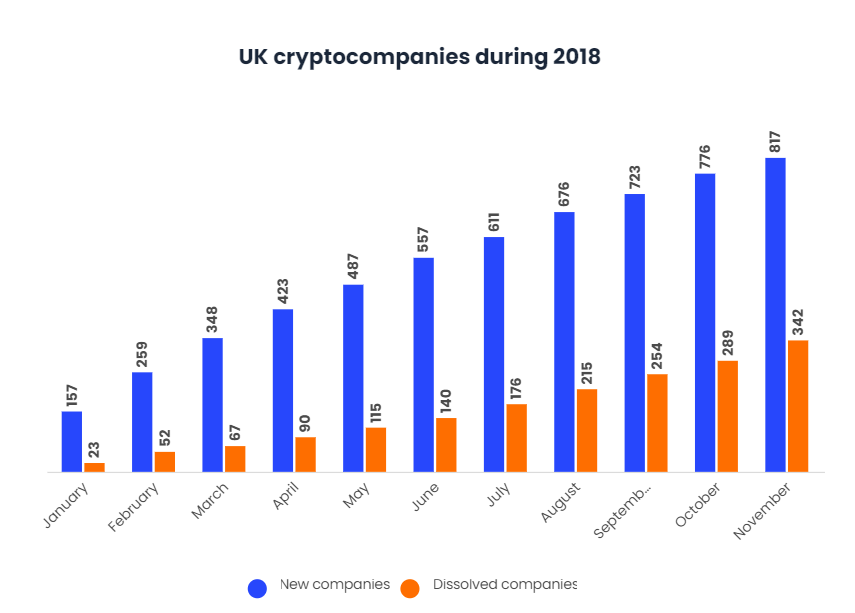

This precaution may be due to situations similar to that experienced in the United Kingdom where throughout 2018 there was a 144th increase in the closure of blockchain-related companies, according to a report published by Sky News.

Cryptocurrencies are the main driving force

The emergence of cryptocurrencies, and in particular Bitcoin, as potential dominant financial instruments, led financial services to move first in blockchain experimentation, placing them between 18 and 24 months earlier than others industries in the industry lifecycle. Given that gap, it’s not surprising that previous concerns in banking are now emerging elsewhere, and that initial enthusiasm is eroded by a growing sense of underperforming.

The reality is that, instead of following the classic upward curve of the industry’s life cycle, it seems that the blockchain has stopped in the first phase. However, as 2019 progresses, the practical value of blockchain will be mainly located in three specific areas:

- Niche applications:

There are specific use cases for which blockchain is particularly suitable. They include data integration elements to track asset ownership and asset status. Examples can be found in insurance, supply chains, and capital markets, where distributed ledgers can address weaknesses, including inefficiency, process opacity, and fraud.

- Value of modernization:

Blockchain attracts industries that are strategically oriented towards modernization. They see blockchain as a tool to support their ambitions to pursue digitization, process simplification and collaboration. In particular, global shipping contracts, commercial financing and payment applications have received renewed attention under the blockchain banner.

However, in many cases, blockchain technology is a small part of the solution and may not involve a true distributed ledger. In some cases, the renewed energy, investment and collaboration of the industry are solving the challenges of the technology involved.

- Reputation Value:

A growing number of companies pursue blockchain pilots for their reputation value; demonstrate to shareholders and competitors their ability to innovate, but with little or no intention of creating a commercial-scale application. You could say that blockchains focused on customer loyalty, IoT networks, and voting fall into this category. In this context, claims to be “blockchain enabled” seem hollow.

Is there a future for blockchain?

Given the lack of compelling use cases at scale and the seemingly consolidated position in the industry lifecycle, there are reasonable questions about the future of blockchain.

Certainly, there is a growing sense that blockchain is a misunderstood (and somewhat clumsy) solution looking for a problem. The outlook is exacerbated by short-term spending pressures, cultural resistance in some sectors (blockchains can threaten jobs) and concern about disruption of healthy income sources.

Moreover, from the existing challenges with regard to governance: making decisions in a decentralized environment is never easy, especially when accountability is equally decentralized.

It is estimated that there will be more than 20 billion connected devices by 2020 that will use this technology, which will require data management, storage and recovery. However, today’s blockchain devices are inefficient data niches, because each node in a typical network must process each transaction and keep a copy of the entire state.

The result is that the number of transactions cannot exceed the limit of a single node. And blockchain networks become less responsive as more nodes are added, due to latency issues.

Finally there are concerns about cybersecurity. Advances in quantum computing are creating major challenges to blockchain technology. Google said its quantum prototype was 10 million times faster in 2016 than any computer. This raises the possibility that quantum computers may hack codes used to authorize cryptocurrency transactions; a particularly worrying threat to a network claiming to be resistant to fraud.

Still, not everything is lost. Many of the validation protocols currently used are likely to be updated or replaced over the next two to three years.

Cardano, for example, is a so-called third-generation technology and the industry’s first platform to leverage peer-reviewed open source code. The protocol is designed to be resistant to quantum computing.

There have also been some promising developments in use cases, outside the financial industry. Recent experiments in supply chains, identity management and the exchange of public records have been positive.

An emerging perspective is that blockchain application can be more valuable when it democratizes access to data, enables collaboration, and solves specific pain points. It certainly provides benefits in cases where it transfers ownership of corporations to consumers, sharing the “proof” of the provenance of the supply chain more vertically and allowing transparency and automation .

Will the blockchain advance in its lifecycle?

There is no guarantee that any blockchain application will advance to the second stage of the lifecycle. Doing so will require sound justification, significant capital and greater standardization.

Fintech leaders should have a more nuanced view of their target industries and hire the right talent. To get there we see three key principles as minimum conditions for progress:

- Organizations should start with a problem:

Unless there is a valid problem or pain point, blockchain is probably not a practical solution. Companies must honestly assess their appetite for risk reward, level of education and potential gain. They should also assess the potential impact of any project and supporting business case.

- There must be a clear business case and an objective ROI:

Organizations must identify a justification for investment that reflects their market position and is supported by the board and employees, without fear of cannibalization. Companies should pragmatically consider their power to shape ecosystems, set standards, and address regulatory hurdle, all of which will inform their strategic approach.

The value of Blockchain comes from its network effects, so most stakeholders must be aligned. There must be a government agreement that covers the standards of participation, ownership, maintenance, compliance, and data. Financial arrangements must be agreed in advance to ensure sufficient financing until commercial launch.

- Businesses must accept a mandate and commit to a path to adoption.

Once a use case is selected, companies must evaluate their delivery capacity. Sufficient economic and technological support is essential. If they overcome those obstacles, the next step is to launch a design process and collect elements that include the blockchain platform and hardware. They must then set performance targets (transaction volume and speed).

At the same time, companies should establish the necessary organizational frameworks, including working groups and communications protocols, so that development, configuration, integration, production and marketing (to drive large-scale adoption) receive sufficient support.

According to research conducted by the professional portal LinkedIn, the sector for the development of solutions with Blockchain technology has experienced rapid growth, even more pronounced than that of most emerging industries registered on the platform.

According to data reviewed by the study, the “Blockchain Development” category registers a lawsuit by employers that exceeded 33 times the number of offers published for 2017, this increase in specialized workforce is significant for the evolution of technology within its life cycle.

This data is backed by those published by the Upwork platform which indicated how the demand for skills related to Bitcoin technology and Blockchain became the trend with the greatest boom within the network during 2018.

Conclusions

Conceptually, blockchain has the potential to revolutionize business processes in industries from banking and insurance to shipping and healthcare. Still, the technology has not yet seen significant implementation at scale, and faces structural challenges, including solving the innovator’s dilemma.

Some industries are already degrading their expectations (providers have a role to play there), and more “dose of realism” is expected as experimentation continues.

Companies that are prepared to carry out the implementation of blockchain must adapt their strategic playbooks, honestly review the advantages over more conventional solutions and adopt a more sensible trading approach. They should be quick to leave applications where there is no incremental value. In many industries, the necessary collaboration can be better undertaken with reference to ecosystems that are beginning to reshape digital commerce.