Are paid subscriptions the definitive business model?

Subscription-based services are fully intertwined with society: music, TV, movies, video games, grocery boxes, beauty items, clothing, cosmetics and toys are more expensive than many people think.

This may be the best innovation for businesses that the economy has seen in decades. For example, in the United States alone, the cost of paid subscriptions is $240 per month. However, this revolution does not stop at users, the subscription economy has revolutionized the way B2B organizations work with each other, how they operate and how they solve problems.

Who could benefit?

More than 20 years ago, the first software-as-a-Service (SaaS) went public, but SaaS companies are not the only option in the world of “subscriptions”. The number of service companies that have incredible opportunities to take advantage of subscription models is endless.

The real value of these models comes when organizations get the right solution, at the right time, and always at the right price. And all without the hassle of looking for something new when the material needs to be replaced.

It is a model that benefits both the client and the company. In the subscription economy, consumers want the freedom to access services anytime, anywhere. They want the latest technology or product model available at all times. They demand a variety of payment methods, flexible pricing options, the ability to customize the package, and the freedom to pause and resume services.

The “as a service” business model is, without a doubt, the most important and fundamental digital transformation that companies must make in order to compete and win in this new era. In this new world of subscription services, companies need to orient their business around their subscribers, not their products.

Unlike the old product model, the product itself is no longer a one-off transaction but a continuous service. Therefore, the focus is on building long-term, personalized relationships with loyal subscribers, not unit sales.

As proof of this over the past seven years, underwriting companies in North America, Europe and Asia Pacific have seen their sales grow by more than 300%, representing a compound annual growth rate (CAGR) of 18%.

Which way should companies go?

The boom in the subscription economy has been a major obstacle to the traditional business model, particularly in retail. By offering services instead of things, innovators have created customer loyalty and the holy grail of retail: recurring revenue.

Subscription models are good for consumers, excellent for the environment and a blessing for business. But how can investors make those profits?

The biggest benefit for investors is recurring revenue, which means predictable revenues, allowing companies to invest in their growth. In addition, subscriptions lead to greater customer engagement and a deeper understanding of their needs, which means that underwriting companies are in a stronger position to predict those areas of growth.

Making a smart investment is not just about recurring revenue. There are three metrics to monitor that can help you make a smart investment:

- Rotation rate

- Annual recurring profit margins

- Growth Efficiency Ratio

The turnover rate is a key concern for the subscription industry. Nearly 40% of users who subscribe to an e-commerce have cancelled their subscriptions. The higher the turnover rate, the more difficult it will be for e-commerce subscription companies to cover acquisition costs and increase revenues.

Those who quit, do so quickly. More than a third of consumers who subscribe to a subscription service cancel in less than three months and more than half cancel in six. For example, the food kit industry has particularly high cancellation rates in the first six months (between 60-70%), reflecting the competitive nature of this niche.

Challenges you will face

As we have seen, no model is exempt from disadvantages. Another challenge for the subscription business is acquisition, subscribing to a recurring order “buffers demand” and makes it difficult for companies to acquire customers.

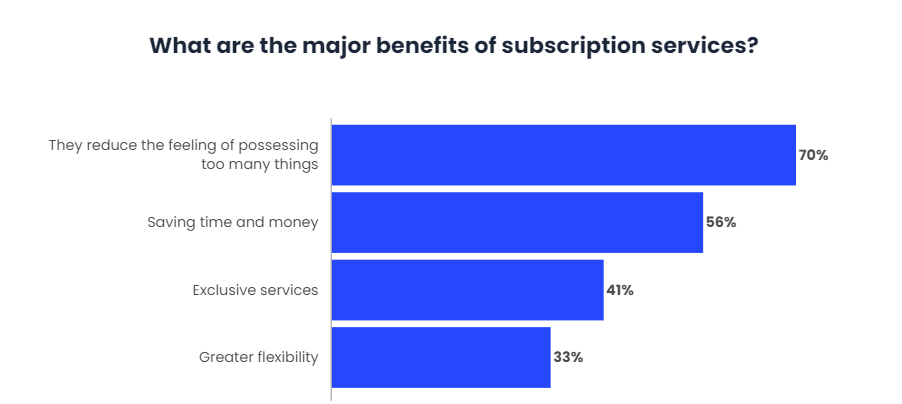

Consumers do not feel an inherent loyalty to subscriptions. Rather, they want a great end-to-end experience and are willing to subscribe only when automated purchases bring them tangible benefits, such as lower costs or greater customization.

On the other hand, experts and executives of underwriting companies cite the increase in word-of-mouth marketing as another factor in the failure of some underwriting services.

In recent months there has been a significant increase in this problem in the subscription economy: customers can easily complain across networks and share their opinion, which means that it is now much more difficult for a bad product or service to succeed.

What future for the subscription economy?

Despite the challenges of acquiring and maintaining users, the industry shows few signs of slowing. The latest report on subscription services concludes that subscription-based services are the future, 22% of all subscribers (specifically 44% of users between the ages of 16 and 24 expect to use more services in the next two years.

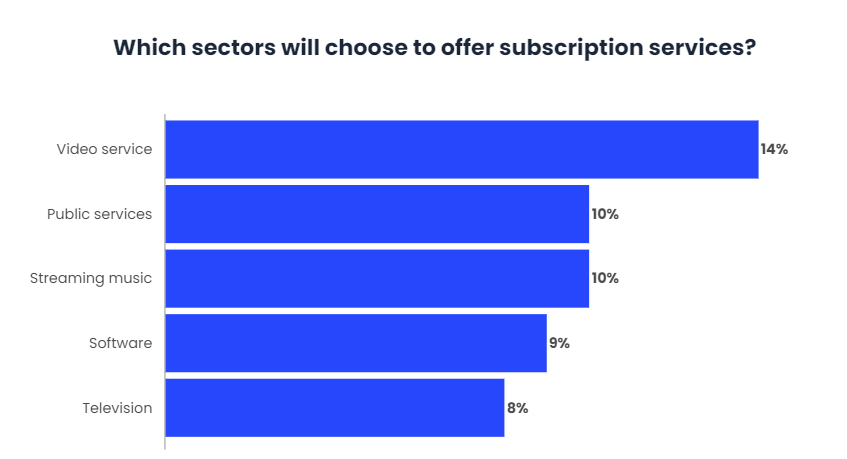

This digital transformation will further favor a number of industries including video services subscription, utilities, music streaming services, fitness services, TV and software/storage.

Not surprisingly, companies want to change their operating model to take advantage of the opportunity to earn long-term stable revenues. However, for change to be successful, the company needs to engage customers in its ecosystem.

They must put the user at the heart of the business, from how it is promoted, such as the digital experience, to creating rewarding experiences that generate continuous word-of-mouth promotion. This will mean a better experience and a feeling of connection with the brand.

Conclusions

With a compounded annual growth rate of 18% over the past 5 years, the global economy of subscription trading shows no signs of slowing. Established companies and new market entrants, as well as companies considering developing an underwriting aspect of their business, must take into account consumer demands and fierce competition in this space that must be balanced for profitability.

The key drivers for underwriting are convenience and the added benefit of exclusive access to new tangible securities. Staying close to the customer and listening to their thoughts and comments, whether in the form of proactive contributions on their part, will create new customer service commitments.