5 Things You Should Know About Financial Crime Prevention

(See my previous blog post/interview on potential data exposure risks and future trends and challenges)

The recent Target, Apple Pay and JP Morgan hacking incidents have made headlines and raised alarms across the globe, but they’re just the tip of the iceberg.

Global financial crime has seen alarming increases in the last five years— and the forecast promises increasing chances of fraud and money laundering.

According to PwC in their 2014 Global Economic Crime Survey:

- More than a third of businesses reported being a victim of a financial crime—that’s a rise of 23% from 2009

- 50% of CEOs see lack of trust as a key problem in the marketplace—the trust that is key to convincing the marketplace to favor you with their dollars

- And 1 in 5 organizations experienced financial impact ranging from $1 million to $100 million because of financial crime.

The growth of technology—which has brought breathtaking productivity enhancements to business—has also enabled cyber-criminals intent on perpetrating financial crime. But in case you think it’s only financial institutions that have to watch out, think again.

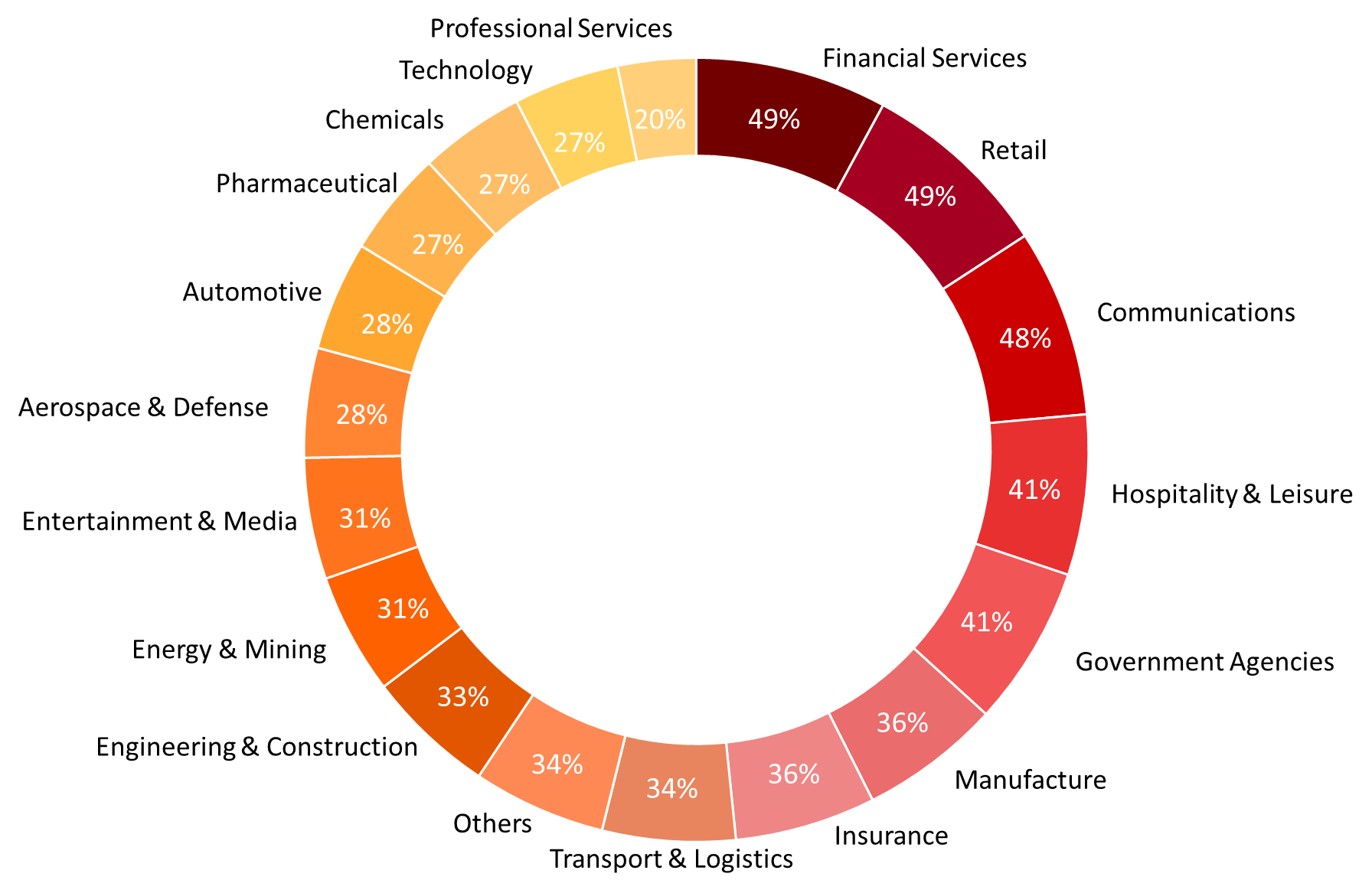

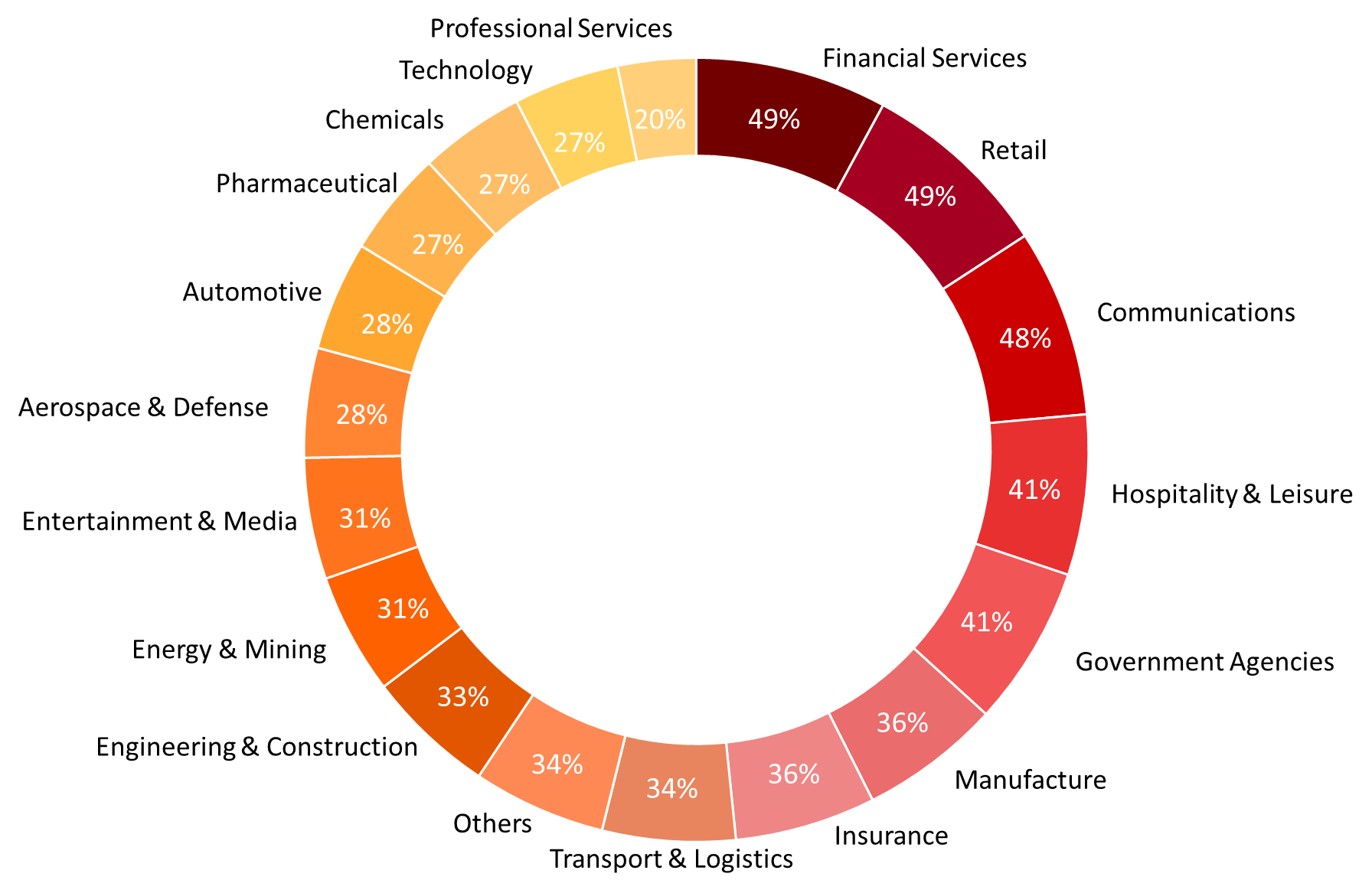

As PwC reported, financial crime is affecting industries as diverse as Aerospace & Defense, Entertainment & Media, Communications, Hospitality & Leisure, and Manufacturing to name a few.

Indeed, these facts are frightening.

To help your organization plan and prepare for financial crime prevention (FCP), here are five things you should know as you plan your FCP programs.

1. FCP Prevention Technology Is Only As Good as Your Processes

Technology is an enabler for money launderers and the perpetrators of fraud. From the use of smartphones as in the recent Apple Pay fraud cases, to the use of micro-deposits from multiple accounts that can be executed with just a keystroke, technology has become a catalyst.

But financial crime follows pretty predictable patterns. There are telltale signs that can tip off organizations that have the proper technology infrastructure and practices.

Applications such as NICE Actimize enable organizations to detect these patterns through sophisticated data analytics to stop financial crime in real-time.

However, the software is only as good as the patterns you’ve identified. What are these patterns? Here are a few examples:

- Sudden large purchases by current customers, or large purchases by new customers

- Unusual patterns displayed by customers or suppliers who are on a watch lists of known money launderers of fraudsters

- Sudden large cash purchases at electronics, jewelry or furniture stores,

Detecting these patterns depends on your knowledge of financial crime behaviors, the thresholds you set and access to robust analytical capabilities to detect financial crime as it’s happening.

2. Financial Crime Is Affecting Non-Financial Entities

Traditionally, financial crime was seen as only affecting financial institutions. But according to PwC, most industries should now worry about financial crime.

Here are a few examples of how criminals are targeting non-financial entities:

- Manufacturing. If you’re a manufacturer and you deal with dozens, if not hundreds, of suppliers, you’re especially susceptible to money laundering. You need to know who your suppliers are so you’re not inadvertently harboring money launderers.

- Retail. The Target incident put retailers on the map as potential victims of financial crime. But there are other, slightly more innocuous ways retailers are becoming victims: the use of stolen credit cards online, purchasing multiple gift cards with cash, or sudden large cash purchases (if you’ve ever seen somebody buy 20 TV sets in one shopping trip, that person might be a money launderer).

- Communications. The use of cell networks to relay stolen credit card information and the cloning of phone and credit card information to create mirrored smart phones, such as in the Apple Pay case.

If you are in any one of these industries be aware not only of the potential losses from fraud, but also of potentially massive fines from regulatory agencies.

3. Regulation Now Affects More Than Just Financial Institutions

Fines assessed by government institutions, such as the Department of Treasury’s Financial Crimes Enforcement Network (FINCEN), are now targeting other industries as well.

Regulatory entities now consider money laundering anything that has an unknown origin. For instance, even if you’re participating in goodwill transactions with other entities, if you’re not using the proper procedures to detect where that money comes from then you could be prosecuted for laundering money.

In the past you never had to worry about participating in these types of transactions. But now the government can indict you just for doing a transaction—even if the customers are known to you.

And the potential fines can be very damaging.

4. The Costs of Financial Crime Have Expanded Beyond the Dollars Lost

Financial crime imposes a cost beyond the mere economic losses from fraud. The financial costs have now expanded into two important areas: potentially massive fines from regulatory institutions, and.

- Massive Fines: Regulatory entities, as mentioned above, are becoming more proactive across all industries. Some of the fines are huge, such as the $1.7 billion settlement between JPMorgan Chase & Co. and the government.

- Damage to reputation: Financial institutions as well as whole nation-states have been taking significant hits to their reputation as a result of money laundering and fraud. In 2013, The People’s Bank of China issued new anti-money laundering rules to curb billions of dollars in fraud and money laundering transactions, leading some experts to claim China “…as the world’s biggest source of ‘dirty’ funds. And in 2015 Panama’s legislature unanimously passed legislation to “clean up its reputation” as Latin America’s “premier hub for money laundering” by toughening supervision of non-financial sectors directly involved with illicit operations.

5. The Growth of Financial Crime Due to Technology

As I mentioned earlier, financial crime is on the rise, and it’s being enabled by the growth of new technology.

That puts financial entities into a paradoxical situation: they’re responsible for customer protection, and they are also subject to fines.

According to the Australian Crime Commission, “Computers, smart-phones and the internet are now linked to almost every part of our daily lives. This creates new vulnerabilities that organised (sic) crime groups are quick to exploit. Criminals are using this technology to conduct new crimes and to commit traditional crimes in new ways.”

The recent Apple Pay fraud is the most high-profile example of the exploding, technology-enabled mobile payments market, which is expected to rise from $52 billion last year to $142 billion by 2018.

Apple Pay was introduced in October and enables owners of iPhone 6 and 6 Plus to load their credit card information in order to make purchases with their phones.

But this new technology has also opened up a hornet’s nest of criminal activity. According to Bloomberg, some credit card issuers “…have found as much as 8 percent of Apple Pay transactions to be fraudulent, compared with 0.1 percent on traditional payments cards.”

So while technology advances make our lives better, it’s also given fraudsters and money launderers new ways to do their mischief.

What You Can Do

If you’re feeling stressed and wondering if there’s anything you can do, don’t worry: there are steps you can take to help mitigate your chances of being a victim of financial crime. At Softtek we recommend that our clients implement an Economic Crime Prevention Program, a general framework that contains all the processes and enablers you need in order to prevent crime.

This is something you could build yourself or with the help of a third party with an experienced team and a deep knowledge base of financial crime prevention best practices, like Softtek.

The program consists of combining software with processes. The technology tools you need include data mining capabilities, data protection, and the procedures to properly run the applications according to your company’s unique situation and industry.

Then you have to get your processes in order. Do your business practices make you susceptible to money laundering? Do your activities increase the risk of fraud? Do you have to abide by certain regulations? Are you doing business with countries such as the U.S. or China?

It’s important to perform a full assessment of your particular situation because you might determine you don’t need a full implementation.

This often turns out to be more complex for organizations to perform themselves, in which case it’s wise to hire a third party. Learn more about Softtek's Financial Crime Prevention services, here.