The market for Robo-advisors has not yet taken off

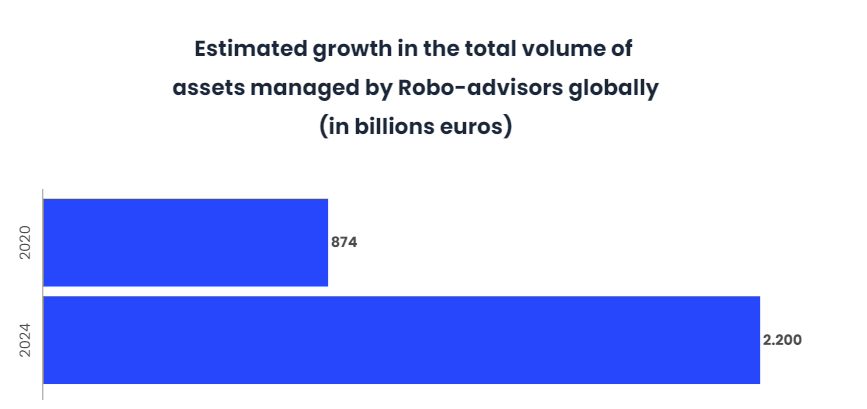

Robo-advisors seem no longer to be the threat they once posed to traditional industry. In fact, over the years, large banks have also adopted this automated investment model, and the volume globally managed by Robo Advisors is expected to grow from 874 billion in 2020 to 2.2 trillion in 2024.

The general characteristic in all of them is the low commissions and low entry barriers, the keys with which they intend to achieve their objective of universalizing automated investments.

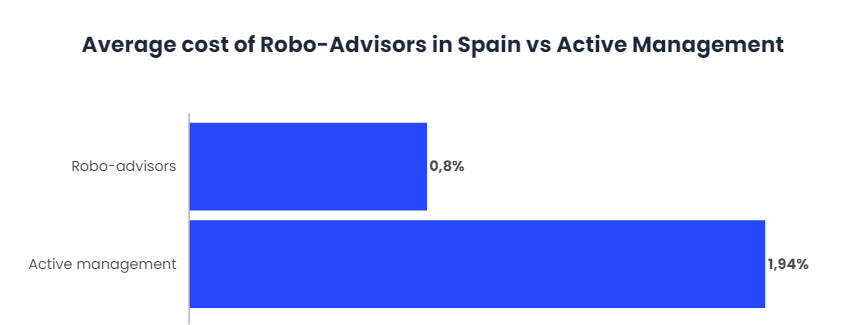

In the Spanish market, although there are variations between each Robo-advisor, there seems to be a consensus in the market regarding prices and access limits. In this sense, most of them require a minimum investment of 1,000 euros. And in terms of prices, there is downward competition, especially against traditional managers. Thus, on average, investing in a Robo-advisor in Spain is 1.14% cheaper than doing so through, for example, stock market funds.

It has also been found that the commissions of Roboadvisors belonging to traditional banks are substantially higher. This has represented the beginning of this downward price war which is intended to generate a revulsion of competition so that the sector can finally begin to take off.

On the basis of these data, it can be said that the limit to further lowering prices would be reached, except for the possibility of downward price stabilisation for which some of the competitors will first need to gain more volume of assets under management.

Business is still not profitable

Despite the initially optimistic trajectory, many feel that the Robo-advisors have stagnated in recent years. Despite the good forecasts and the wide scope for expansion that the sector has ahead of it, the latest results show that the main automated management firms in Spain would accumulate losses of close to 10 million euros since their launch.

Thus, although all of them have increased their volume of assets under management in the last year, they have not yet managed to become profitable and have accumulated significant red numbers since their launch.

Some experts maintain that the main obstacle investors face is lack of confidence. In fact, 91% of investors are not comfortable with a machine handling their financial decisions. These confidence problems could be slowing down the rise of Robo-advisors, because if a large majority of people still do not feel safe letting Robo-advisors handle their money, it will be difficult for this technology to catch up.

In addition to the lack of confidence, Roboadvisors also have serious contextual limitations. In other words, they are limited to doing exactly what they are told to do, no more and no less.

Robot advisors lack the foresight and long-term planning skills that human advisors have. This means that Robo-advisors cannot draw up complex investment plans and cannot reason with hypotheses. In addition, Robo Advisors are not able to reason from incomplete information or make assumptions about what kind of investments their clients would like. If a Robot-Advisor is not specified to do something, it will not do so. A human advisor might use inductive reasoning to find out what to do when he has not been explicitly told what to do.

Despite this, in this race to finally get off the ground and be profitable, competitors are still making important moves.

What is the future of the Robo-advisors?

So, have the Robo-advisors finally stalled or do they still have the potential to drastically change the investment world? For Robo Advisors to thrive they must overcome a number of challenges.

As discussed in the previous section, perhaps the biggest challenge facing Robo Advisors is that they cannot currently offer the same services as human advisors. Despite the name, Roboadvisors do not ‘advise’ anyone. All they do is automate parts of the investment process.

It cannot be claimed that current Artificial Intelligence (AI) technology can offer the services of a human advisor, however, great advances have been made in this technology in recent years, and it is not known what it might lead to. The idea that in the medium/long term you could have machines capable of making projections and financial planning may seem absurd, but so was the idea of 100 years ago of taking a human being to the Moon.

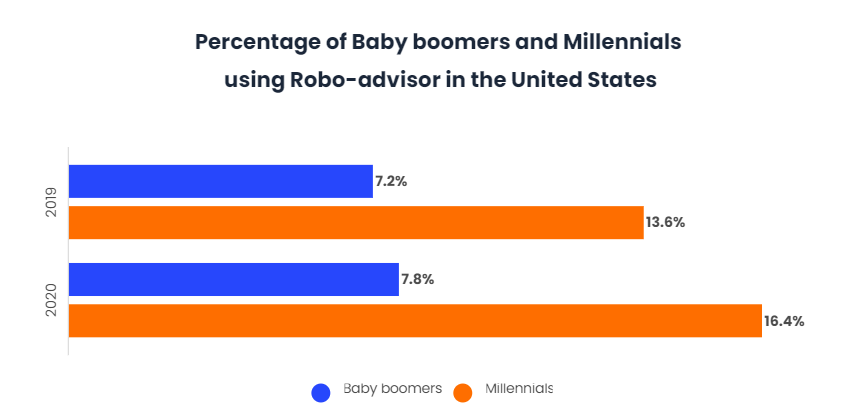

The other major challenge affecting Robo-Advisors, as has also been seen, is the lack of confidence. Most people do not feel safe leaving their financial well-being in the hands of machines. But, while it is true that there are still many people who do not trust this technology, more and more users see the benefits it brings and are willing to use the service. It is only a matter of time before the rest of the users follow this path.

In addition, younger people, in general, are more likely to be open to the use of automated technology to manage their investments in the future. As Millennials get older and constitute a larger part of the investment population, the number of investors using this technology is likely to increase. For example, in the United States only 7.2% of baby boomers used a RoboWarner in 2019, that figure increased to 7.8% in 2020. However, for the Millennials, 13.6% used a RoboWarner in 2019, and that figure increased to 16.4% in 2020.

Conclusions

The Robo-Advisors sector in Spain is not yet fully off the ground and remains at levels of adoption far below those seen in Europe or the United States. Investment continues to be dominated by traditional active management products and large banks.

In addition, the main Robo-Advisors operating in Spain have not yet managed to make a profit since their launch and are accumulating significant numbers of red numbers.

However, growth forecasts remain good. The field of expansion is still very large and all competitors are growing both in financing and in the number of clients and volume of assets managed.

The whole sector is immersed in a competitive war where the price battle is beginning to reach its limit.