No slowdown in sight for AR and VR in media and entertainment

Augmented reality (AR) and virtual reality (VR) technology advancements continue to redefine the media and entertainment (M&E) industries. AR/VR technologies are creating more immersive experiences with deeper engagement between content creators and viewers. AR/VR usage has been given a boost with the Covid-19 pandemic, as they have often replaced in-person interactions with digital connections in personal, professional, and entertainment arenas. Further, the commercialization of 5G technologies will make AR/VR much more accessible with reduced latency and increased data streaming bandwidth.

The US leads the way as the AR/VR market sees strong growth

It’s estimated that the global AR/VR market will grow to $766 billion by 2025, increasing at a CAGR of 73.7%. North America remains the market leader, with the US estimated to reach $308 billion by 2025, increasing at a CAGR of 78.3%. Europe accounts for the second-largest market share, forecast to reach $169 billion by 2025.

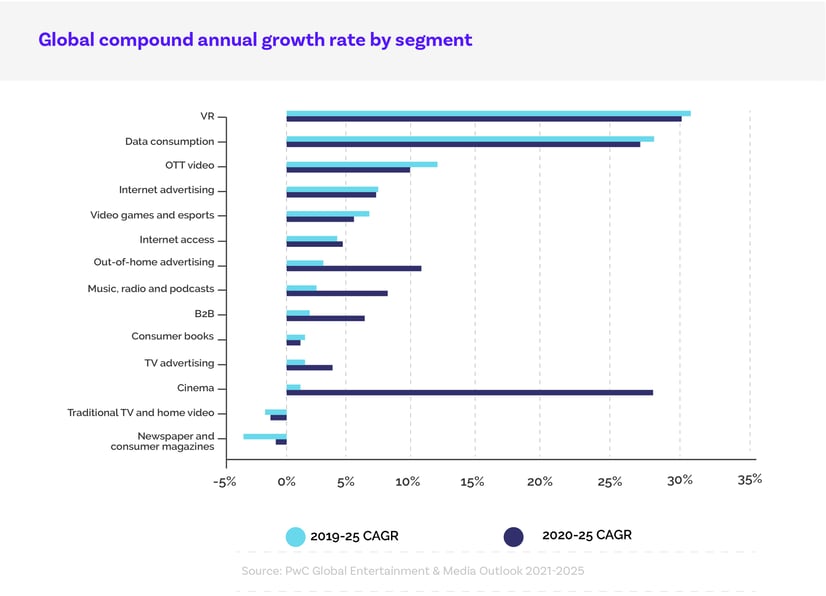

As reviewed in PwC’s report, Power shifts: Altering the dynamics of the M&E industry, VR is the fastest-growing segment, with 2020-2025 revenues rising at a CAGR of 30.3% to reach $6.9 billion in 2025 from $1.8 billion in 2020.

Rising global demand for VR headset/head-mounted display (HMD) in M&E

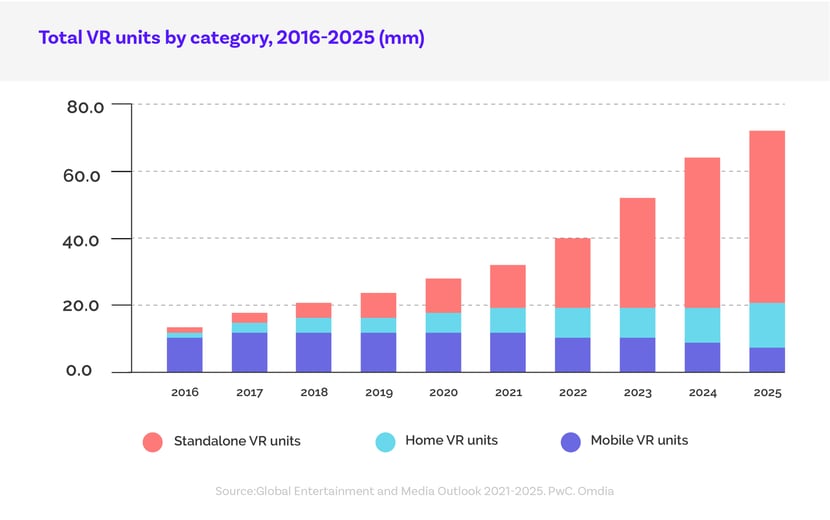

According to the same PwC report, VR headsets saw solid revenue growth of 30.7% YOY in 2020, although it fell short of its full potential on the back of the Covid-19 pandemic. The growth has been led by new game developments, improving VR technology, and consumer interest in high-quality mobile headsets. At the same time, VR headset providers have benefited from growth in commercial HMD applications.

Within the product mix, mobile VR revenue continues to grow at a strong pace, overtaking market share from standalone VR units, primarily due to the increasing penetration of smartphones.

According to a market analysis report from Grandview Research, within the VR segment, head-mounted display (HMD) devices constituted over 60% of the overall market share in 2020. HMD’s dominance is due to adoption in the M&E industry plus its application in educational, therapeutic, and training purposes across sectors. This is followed by gesture tracking devices (GTD) with ~20% market share, and the remaining ~20% by projectors and display walls (PDW).

Prevalent AR/VR technology trends in the M&E segment

AR/VR affordability and gaming popularity boost investment and demand

AR/VR technologies have wide applications in the M&E sector and form a key growth area in the US and global markets. This is driven by several factors including the rising penetration of smartphones, heightened popularity of gaming and eSports, and the increasing affordability of AR/VR technologies.

Consequently, according to Statista, AR/VR technologies are expected to receive large research investments in 2024, with “VR gaming, VR video/feature viewing, & AR gaming” use cases receiving $17.6 billion; training and industrial maintenance use-cases at $4.1 billion each; and retail showcasing at $2.7 billion.

Technology giants continue to develop AR/VR to bring accessibility, mobility, and pricing to the market

Several technology giants have realized that AR/VR will be among the most widely used technologies and are building products. Notable active companies in the segment include Microsoft, Meta, HTC, Sony, Google, and HP. Several examples include:

- Microsoft: In March 2021, Microsoft launched its Mesh platform and HoloLens, combining the AR and VR use cases in the US military and a range of industry verticals including M&E. Microsoft Mesh and HoloLens enables people to collaborate as if they were all physically present in the same room. Through Mesh-enabled experiences, people can meet as 3D avatars or photorealistic representations of themselves in AR/VR/MR. Proximity and spatial audio let people know where they are relative to one another. Use cases include meetings, collaboration, teaching, digital twin research, and remote troubleshooting of industrial printers.

- Meta’s Facebook has made a series of acquisitions in the gaming space including BigBox VR, Unit 2 Games, and BeatGames. It’s also building AR/VR products to support its gaming and metaverse initiatives. “The goal that we’ve had is to continue to develop new use cases beyond just gaming that make VR something that people use in multiple areas of their lives,” said Andrew Bosworth, CTO, Meta (October 2021).

Consumer opinion on 360-degree video hints at VR video growth

Although gaming produces most of the VR content today, VR video will also see a 2020-2025 CAGR of 17.9%. Bulky and expensive headsets are the main growth-inhibiting factors. Still, 360-degree videos like NASA’s 360 view of the moon (which do not require a VR headset to view), have become popular on social media and could be indicative of VR video growth.

VR sports gain ground

VR sports is an emerging industry that has already witnessed funding and sponsorships in the billions of dollars. European football teams such as Manchester City and Juventus are experimenting with AR/VR and are developing interactive apps to be used with Meta’s Oculus headsets. Further, Facebook is also exploring ways to emulate the National Basketball Association’s Courtside Seat service in VR.

eSports are contributing to speedy AR/VR growth

The eSports industry has received wide attention, with competitions held for games such as Riot Game’s LoL eSports, Blizzard’s Overwatch League, Activision’s Call of Duty League, and EA Sports FIFA 21 Global Series.

AR/VR continues to grow in eSports: Aim Lab is partnering with Riot Games to develop a VR First Person Shooter game based on Riot’s Arcane-themed animation. In addition, VR Master Leagues has emerged as a VR eSports league since 2017 with games such as Onward, Echo Arena, Pavlov, and Snapshot. eSports video game developers continue to look for opportunities to play and view their games with AR/VR technologies.

As more industries adopt AR/VR, pay attention to how it revolutionizes M&E in the coming years

AR/VR technologies present a more immersive way to converge real and digital worlds and will open an array of B2C and B2B possibilities across industries. As various sectors apply AR/VR to rethink how we educate, train, collaborate, and work, M&E companies are ready to do the same with how we consume content and entertain ourselves.

This article was written in conjunction with Kurt Nipp, M&E Industry Lead at Softtek. Visit Kurt's author profile to connect with him, read about his experience, and discover his expansive knowledge of the video game subsegment in his blog posts.

.jpg?width=352&name=florian-olivo-Mf23RF8xArY-unsplash%20(1).jpg)