How Bank CIOs Are Becoming Digital Banking Heroes

Banks and other financial institutions are facing multiple competitive pressures from many sources – but unfortunately they’re not doing a great job of keeping up. Consumer expectations have been shaped by the explosion of mobile apps and social media, and beautiful user experiences and instant gratification are mandatory items by consumers today.

But banks have got to look beyond improving customer experience. They also need to stay ahead of the innovation game. A whole cadre of FinTech startups have been disrupting the Financial Services arena by using innovation , leaving banks in the dust.There’s a digital technology and strategy gap that has been keeping financial institutions back. Most importantly there is an IT digital gap with outdated skillsets, process and technologies. Some banks are still using outdated IT management and IT Financial Management models.

What is a bank CEO, and his right-hand person, the CIO, to do? How can they close this digital gap? They need a road map to help them innovate, while managing the new digital risks innovation introduces.

The Bank CIO’s Innovation Toolkit

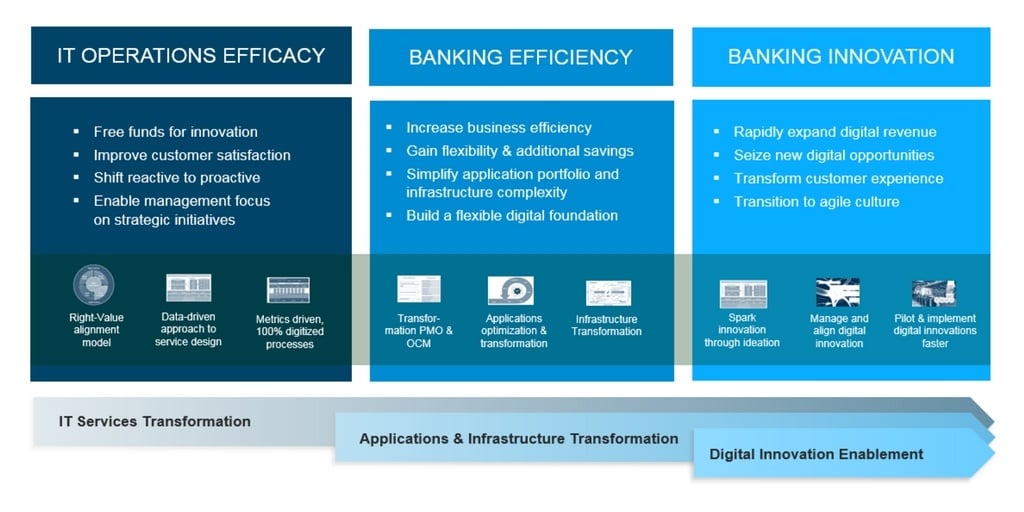

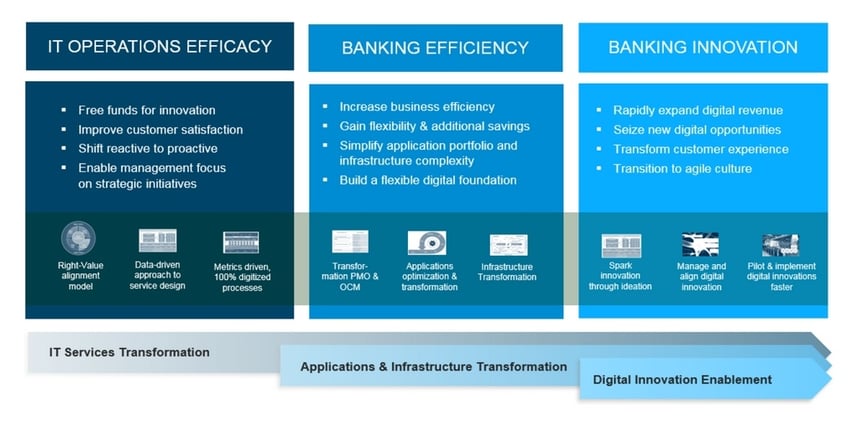

To close this gap, there are three things bank CIOs can do to help take their organizations to the next level: IT Operations Efficiency, Banking Efficiency, and Banking Innovation.

IT Operations Efficiency

Banks should look at transforming the way their IT operations currently work. I was working with an organization based out of New York. We used the Right Value Alignment model and then we transformed their operations through the use of metrics and a variety of other tools. We helped them evolve a model so they could refocus on services, on service level agreements, and on on digitizing processes.

Banking Efficiency

The second one is banking efficiency. Most banking institutions already have their model, but their applications and their infrastructure are outdated. They must go through a transformational journey to optimize, transform, and build a flexible digital foundation.

They need to assess what applications they’re using and why they’re using them. They must also assess which applications are giving them problems, as well as analyze their productivity.

They should look at the evolution of the technology they’ve been using for banking, and assess whether it’s flexible enough for the future.

Finally they need to look at their hard infrastructure: their servers, storage, and their software. For example, if they have a 50 applications which are focused on leasing & lending, then ask: “Why do we still have 50 applications? Let’s pare these down to 20 that are fully aligned to our business lines and our customers.”

Banking Innovation

The third bucket is digital banking innovation. Many bank personnel still work without digital banking applications. Many financial institutions are behind and don’t innovate enough. But others try to innovate through parnterships or acquisition of FinTechs

For example we worked on a project in which we integrated geospatial information with their Salesforce.com instance. This was an innovative solution for a banking client sales & marketing team which leveraged a SaaS-based CRM.

Another example was when we helped a financial institution build a mobile application that enabled them to retain more clients and build customer loyalty, while providing cross-selling opportunities to sell products like lending products.

Your Digital Transformation Roadmap

Hopefully these three steps can help you plan and achieve your digital banking transformation. We developed these three steps after years of working with dozens of financial institutions, and perfecting the best practices needed to complete this journey.

As a result of our years of working with some of the most prestigious baking institutions, we’re proud to be recognized for the sixth year running by the Everest Group in their PEAK Matrix for Banking AO Service Providers. This year Softtek was recognized for the first time as a Star Performer and Major Contender.

Take a peek at the report to learn more about how we ranked against other organizations.