5G deployment in USA to rely heavily on mid-band spectrum

5G offers a tremendous investment opportunity and is expected to have a similar impact on the US' economic future as the commercialization of the internet did 25 years ago. The main 5G players in the US have already commenced 5G network deployments and are at varying stages of progress.

A shift to mid-band spectrum

5G is paving the way for innovations from remote surgery to self-driving cars to become part of everyday life. But for the time being, speeds are too slow in most locations to make those promises a reality. Among the 15 leading 5G markets in the world, the US has the slowest average speed. In the US, the average 5G speed is only twice as fast as 4G.

Even though the signals do not reach much of the country, the US has focused mostly on high-band spectrum. Other countries, meanwhile, have focused on mid-band spectrum, leaving the US as an exception. Mid-band spectrum has been dubbed the "Goldilocks" of 5G because it offers a desirable combination of speeds faster than low-band while also reaching longer distances. For context:

- High band: 6GHz frequencies and greater. Unparalleled speeds and capacity with a limited coverage area per tower (less than one mile).

- Mid band: Frequencies between 1GHz and 6GHz. High speeds and capacity with a medium coverage area per tower (several miles).

- Low band: Frequencies less than 1GHz. Lower speed and capacity with a huge coverage area per tower (hundreds of miles).

The US government was somewhat late to recognize the potential of mid-band spectrum, and the spectrum was only recently made available to mobile operators. In February 2021, the government auctioned off mid-band spectrum for 5G, netting almost $81.11 billion, surpassing records as the most expensive mid-band 5G spectrum auction locally and globally. The largest spender was Verizon, at $45.45 billion, followed by AT&T's $23.41 billion and T-Mobile's $9.34 billion.

Following the auction's conclusion, the country's major 5G providers have declared they will use mid-band spectrum in their 5G networks through 2021 and 2022. AT&T announced that by the end of 2021, it will start deploying 5G service in the mid-band C-band spectrum. The operator has already covered 250 million people in roughly 500 markets across the country with 5G via dynamic spectrum sharing (DSS) on its 850 MHz band. DSS allows 5G new radio and 4G LTE to share the same frequency, however, it limits 5G download speeds to nearly 50 Mbps.

Securing an average of 161 MHz of C-band spectrum nationwide at the auction, Verizon plans to cover 100 million people with mid-band 5G in 46 markets by March 2022.

T-Mobile's mid-band 5G deployment, which offers download speeds of 350 Mbps, is already available to 200 million people. T-Mobile plans to expand the coverage to 250 million people by the end of 2022.

Mid-band 5G usage categories

5G mid-band can handle multiple 5G application use cases under three main usage categories, including enhanced mobile broadband (eMBB), critical IoT with ultra-reliable low-latency communication (URLLC), and massive IoT with massive machine-type communications (mMTC).

- eMBB – This usage category is an iterative upgrade of mobile broadband. Phones, tablets, hotspots, laptops, and fixed wireless are all examples of its applications. Initial augmented reality use cases and mobile work apps such as virtual desktops and digital workplaces will benefit from the high-speed upload and download capabilities.

- Critical IoT with URLLC – This will cover use cases that have a low tolerance for latency or signal interruptions or drops. Consider smart grids, smart factories, self-driving cars and devices, remote robotics and drones, mobile bio-connectivity, and a variety of other applications.

- Massive IoT with mMTC – This application area is all about massive sensing and the massive amounts of data it will generate. Many monitoring-related use cases, such as inventory management, logistics, and smart home applications, will be automated and connected using massive IoT capabilities. It will also support the development of new types of intelligent wearables.

The COVID-19 disruption

On top of these obstacles to 5G deployments, the COVID-19 situation erupted into a period of prolonged uncertainty. As operators prioritized projects that would increase the resilience of existing networks and support more people working from home, many predicted delays and holdups in 5G rollouts. As fast, reliable internet became a new priority, local government approvals for 5G deployments have reportedly slowed across the US.

However, according to some business leaders, 5G rollouts in the US remain relatively on track. Qualcomm acknowledged that there had been minor delays in 5G deployments in some areas, but said that in the US, some carriers are actually ahead of schedule, likely taking advantage of lower traffic. Despite the disruptions caused by COVID-19, Verizon stated that it is still on track with its 5G rollout.

Future potential: 5G adopter numbers predicted to grow

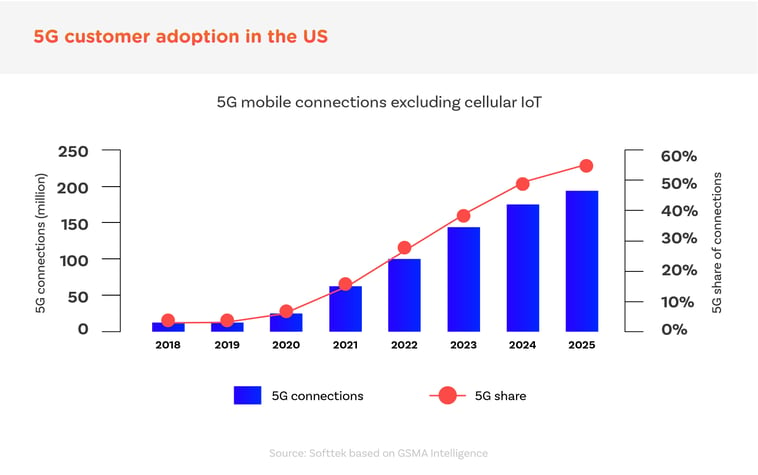

There are already use cases, and more will emerge, and it appears that 5G will continue to increase as demand for bandwidth and mobile apps grows. According to the GSMA, by 2025, nearly half of the US mobile connections would be on new 5G networks, driven by operators' investments in new networks. Furthermore, 5G will most certainly bring significant enterprise opportunities in the future, which corporations are only now beginning to grasp. Factory floor automation will be one of the big use cases. Another is fixed wireless, which could boost connectivity through private 5G networks deployed across organizations, regions, or campuses. By 2030, North America's 5G market is anticipated to be worth more than $180 billion.

Despite the pandemic shifting consumer goals over the last year and potentially slowing down 5G uptake, major 2021 smartphone announcements have a keen focus on 5G connectivity and are expected to drive more adoption of the service through 2022. In addition, 5G deployment in the mid-band could be a game-changer for consumers and businesses in the US. How is your business preparing to benefit from further expansion of 5G? To learn more about how Softtek can help you expand your IoT ecosystem and scale up your mobile application development, get in touch with our Telecommunications team.